Bitcoin’s ongoing bull run has juiced

demand for new mining equipment, putting pressure on manufacturers to

produce enough machines to satiate buyers.

The world’s largest cryptocurrency by

market cap is currently trading at above $11,000 after it surpassed the

$10,000 level over the weekend – a nearly 200 percent jump since

February.

“The surge in bitcoin resulted in

increased demand and supplies were already short,” said Steven Mosher,

head of global sales and marketing at Canaan Creative, maker of the

Avalon miner.

While he declined to disclose the

firm’s order volume, Mosher said in an email that “the current state of

the industry is that inventories are down and demand is high.”

He told CoinDesk:

“It looks like a return to the 2017 Q3, Q4 conditions, where demand was three times the supply.”

Back then, bitcoin’s price had

doubled from July to September in 2017 and further jumped by four times

in the last quarter, reaching almost $20,000.

The price increase over the past several months also led to a

significant drop of the time it takes for new mining equipment to pay

for itself, according to data provided by TokenInsight, a crypto startup

that focuses on mining and trading research.

The firm estimates the average payback period for most mining

equipment in the second quarter has dropped to 60 to 150 days, a notable

decrease from the previous range of 120 to 280 days.

New models

To capture the new opportunities,

Canaan launched a new mining model last month, the AvalonMiner 1041,

which it claims can compute as much as 37 terahashes per second (TH/s)

with electricity consumption at 2,361 watts per hour.

By comparison, an older model, the Avalon 851, performs its

calculations at a speed of around 14.5Th/s, consuming 1450 watts an

hour.

Mosher added that pre-orders for such

models are already queued up to as late as October delivery, due to the

bulk of buying interest coming from larger customers.

Similarly, crypto mining giant

Bitmain rolled out for sale improved versions of its AntMiner S9 model,

dubbed AntMiner S9 SE and S9k just last week. Shipment of the first

batch won’t be scheduled until August, according to the firm’s website.

Even more expensive and powerful

products, such as the WhatsMiner M20, launched by ex-Bitmain chip design

director Zuoxing Yang, are seeing an increasing level of buying

interest.

Yang told CoinDesk that the next

batch of M20s, which are scheduled for shipment as late as October, is

“almost sold out” at the moment.

But Yang added another important reason why the industry’s supply is

having difficulty catching up with the demand is production capacity due

to the limited supply of chips from various vendors to begin with.

“Bitcoin’s hash rate increase just can’t keep up with the pace of the

price jump,” Yang said. “Production capacity is the bottleneck.”

Hash rate boost

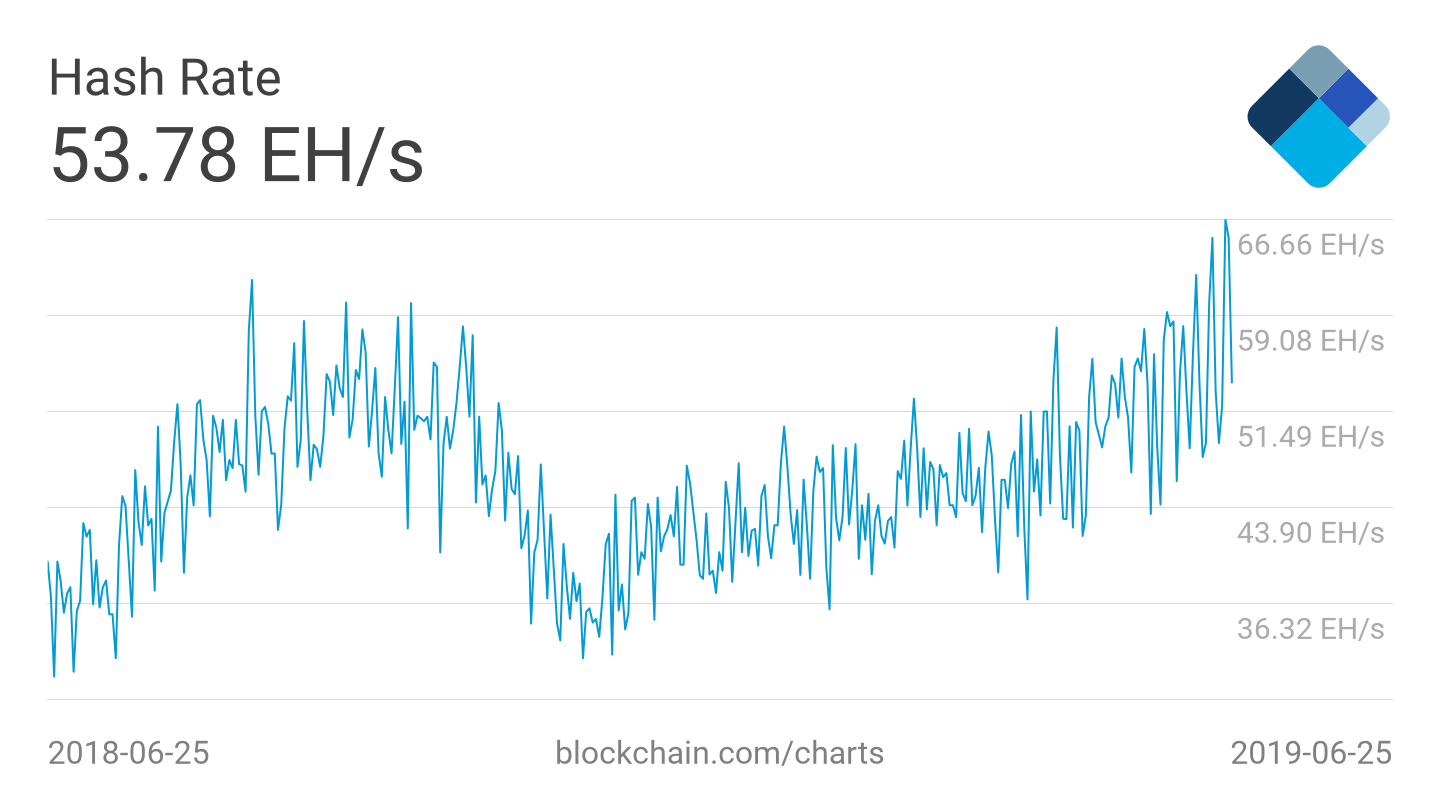

Indeed, the resurgence of mining interest is also reflected in the

overall amount of computing power devoted to securing the bitcoin

network, which recently hit an all-time high.

Based on data from mining pool BTC.com, the latest one day and seven-day average hash rates are at 65 million TH/s and 58 million TH/s, respectively.

This aggregated computing power has

jumped by about 80 percent since late last year when the 14-day average

bitcoin mining hash rate dropped to as low as 36 million TH/s amid

bitcoin’s price decline.

Assuming all such additional

computing power has come from more widely used mining models like the

AntMiner S9 or Avalon 851 with an average hashing power of about 14

TH/s, that would translate to roughly 2 million mining units having been

switched on over the past few months.

As a result, BTC.com estimates that bitcoin mining difficulty

– a measure of how hard it is to solve the math problems that earn new

coins – will further increase by six percent at the beginning of the

next adjustment cycle to an all-time-high level above 7.8 trillion.

source link