The use of digital assets to make payments is growing, according to a recently published study.

It reveals that cryptocurrency’s role as a viable means of payment has

been expanding and this year’s market rebound has increased the turnover

of crypto payments. The report suggests that debit cards linked to

digital currency wallets will remain an important tool until wider

adoption of direct cryptocurrency payments.

Also read: BCH Can Be the Global Coin for Daily Spending, Says Italian Crypto Executive

Crypto Payments Industry Expands With Growing Markets

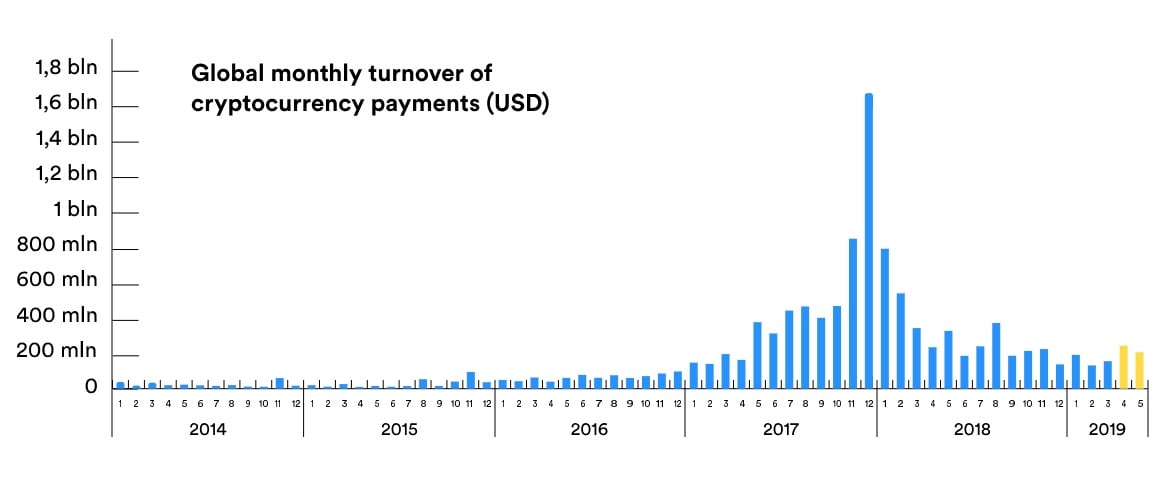

The study highlights a general correlation between upward market

trends and the expansion of the crypto payments industry. Its Compound

Annual Growth Rate (CAGR) increased 21% between 2014 and 2015 and jumped

over 600% two years later. But even during the bearish 2018, when the

price of major cryptocurrencies took a hit, the sector’s CAGR expanded

by around 90% year over year. The recovery that started this year has

had a positive effect and the rising volume of payments this spring

indicates that the recession is over.

The industry assessment has been conducted by Crypterium,

a payment solutions provider that recently launched a crypto debit

card, one of the few products in this niche that’s available globally.

The analysis examines the performance of leading cryptocurrency payment

providers such as Bitpay, Coinsbank, Cryptopay, Spectrocoin, Wirex, and

Xapo. It covers two main types of services offered on the market: those

allowing merchants to accept digital currency directly and solutions

enabling customers to pay with crypto assets through conversion to fiat.

Statistical data gathered by Crypterium shows that the average value

of transactions processed by the payment platforms stabilized during

last year’s decline in a relatively narrow range between $1,000-2,000.

The volume of crypto payments and the average amount have increased in

2019, reaching a seven-month high in April. The researchers believe

that, helped by the crypto market recovery, the increasing number of

payment providers in the sector which offer new solutions for both

merchants and customers will help the industry achieve “gradual and

sustainable organic growth.”

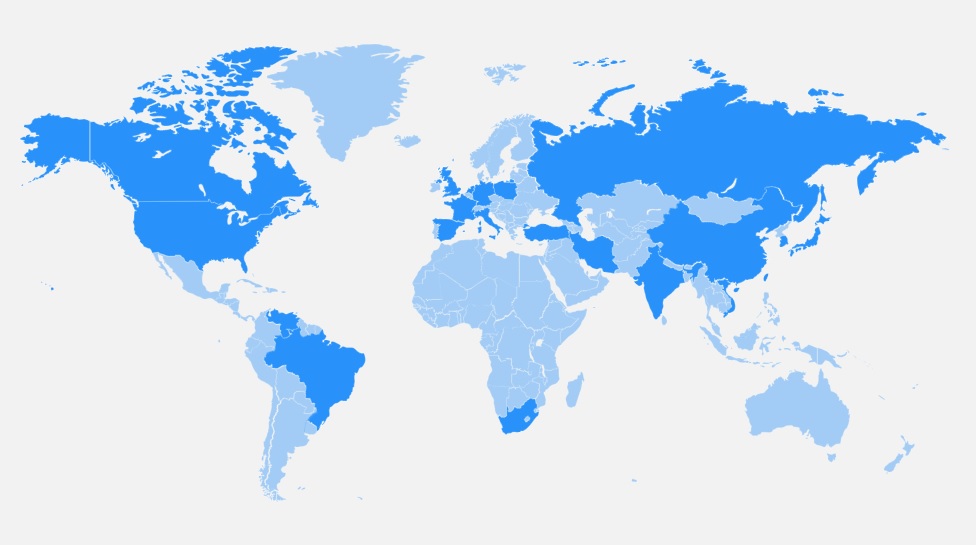

The report further identifies the regions that concentrate the most

crypto holders who are using digital assets to make payments. The

authors emphasize that the number of wallet addresses has been

constantly growing and active wallets worldwide have reached 34 million

in the first quarter of 2019, increasing by 44% just in the last 12

months. According to another study that news.Bitcoin.com covered in May, the figure is even higher – 36 million.

High Income Countries Adopt Cryptocurrency Payments Faster

A key finding in the Crypterium analysis is that cryptocurrency

payments are more popular in high-income nations in general. Based on

data for trading and mining activity from the largest digital asset

exchanges and mining pools, Crypterium has shortlisted the top 20

countries. Coins are increasingly used as a payment instrument in the

United States, United Kingdom, Russia and China. The company concludes

that their adoption is triggered by different factors depending on the

jurisdiction. The most common reasons to trust cryptocurrencies include

the desire to maximize efficiency in payments and the need to protect

assets against hyperinflation.

To better understand why people choose decentralized coins over

traditional payment methods like cash, fiat payment processors and bank

cards, the researchers have analyzed various factors such as debit and

credit card ownership, internet accessibility, mobile phone ownership as

well as macroeconomic indicators including gross domestic product (GDP)

per capita and share of shadow economy. Based on their qualitative and

quantitative assessment, they have grouped the leading 20 countries in

three categories: Innovators, Shadows and Survivors.

The United States, Canada, Germany, France, England, the Netherlands,

Italy, Spain, Japan, and South Korea are the so-called ‘innovators.’

They are characterized by deep penetration of banking and digital

financial services and unrestricted access to mobile services. According

to the authors, they offer the best opportunity for merchants to

capitalize on increasing crypto adoption as most customers there have

access to the internet and own a mobile device.

Medium to low income countries – Russia, China, Brazil, Poland, and

Turkey – have been labeled as ‘shadows.’ Many of their citizens have

lost trust in government institutions, banks and national currencies due

to economic recessions. They often see cryptocurrencies as an

alternative tool to make payments and receive income. The group of the

‘survivors’ includes Vietnam, India, Iran, Venezuela, and South Africa.

Their populations have poor access to traditional banking services and

they look at digital coins as a way to overcome economic challenges like

hyperinflation and save on money transfers.

Debit Cards Remain Viable Option for Crypto Users

Until wider adoption comes around, debit cards tied to crypto wallets

are likely to continue to offer the most applicable solution for

cryptocurrency users who want to spend their electronic cash on a wide

range of products and services. The prepaid cards that can be loaded

with digital coins can be used in both brick and mortar stores and

online platforms to purchase anything that can be bought with regular

bank cards as they convert your crypto assets and merchants are paid

with fiat money. They also allow you to withdraw cash directly from

regular ATMs.

In its study, Crypterium, the issuer of a new crypto debit card,

has mentioned five established platforms that provide this type of

product: Wirex, which offers a crypto card in the European Economic

Area, Coinbase,

popular in the U.K., Bitpay, which is a working option for U.S.

residents, Cryptopay, with its card available in the Russian Federation,

and MCO, which issues Visa cards in Singapore. However, there are many

more options on the market, as news.Bitcoin.com recently reported, such as Paycent, Uquid, Bitsa, and the ADV cards.

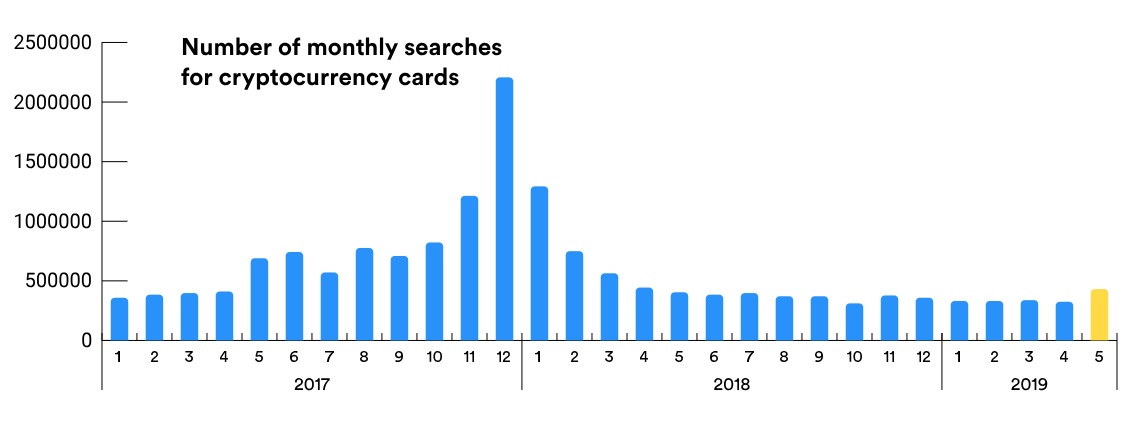

The team behind the in-depth analysis of the crypto payments sector

notes the strong demand for cryptocurrency cards. Companies that

launched such products saw their average monthly turnover figures

increase three times, the authors claim. Again, there’s a correlation

between the state of crypto markets and the interest in debit cards

facilitating cryptocurrency payments. The number of monthly searches for

‘bitcoin cards’ has reached a 12-month high in May 2019. Users

recognize the importance of these cards for mass crypto adoption. Almost

70% of the responders in Crypterium’s 2018 Customer Survey indicated

that cryptocurrency cards are the best option to achieve that at the

moment.

Former Visa Executive Leads Company Issuing Global Crypto Card

The future of crypto cards seems bright, as global payment card

ownership in general is growing rapidly. The number of debit card owners

is expected to double in less than a decade and according to the World

Bank, it will reach 69% in 2020. Crypterium has one of the latest

offerings in the market and it’s also one of the few that can be ordered

anywhere in the world. The Global Bitcoin card

launched recently with support for bitcoin core, ethereum, USD coin and

Crypterium’s own token, CRPT. Nevertheless, the fintech company plans

to expand their number with over a dozen other cryptos within a year and

bitcoin cash (BCH) is one of the currencies it’s considering, Crypterium CEO Steven Parker assured news.Bitcoin.com.

“Cards is definitely a key part of the Crypterium proposition. A

payment card is still the most convenient ‘channel’ to enter the

mainstream payments eco-system and the easiest way to make a payment in

the online and offline worlds and also withdraw your money in cash,”

Parker emphasized. “So we do envisage a growing number of crypto cards.

Our belief is that fiat cards enabling crypto transfers will indeed

become a strong segment in cards. However, we do also see a big

opportunity for NFC channels such as Apple Pay and Google Pay and we

intend to launch those types of service by the end of the year. Also,

our company roots are in QR codes and we are still seeing how we can

integrate that type of functionality. QR codes are huge in China,” the

executive added.

Steven Parker noted there are different flavors across different

regions but he believes crypto payments will grow all around the world.

“Of course, we see the highest ownership of cryptocurrencies in places

like the U.S. and Korea. But as in payments generally, I think we shall

see different adoption rates. Asia is already led by mobile payments, so

I can imagine crypto payments growing faster there. We see large

developing markets such as Brazil or Russia, as a big opportunity. And,

of course, some of the more interesting consumer innovations – prompted

by the Open Banking revolution – is happening in Europe,” he elaborated.

The executive thinks crypto adoption can mirror local financial habits

and Crypterium has integrated, for example, the ability to transfer in

and out via Iban accounts.

Parker spent over seven years at Visa as General Manager for Central

and Eastern Europe and Head of Marketing for the greater region that

encompasses the Middle East and Africa as well. He was approached by

Crypterium in late 2018 with a simple proposition: to make payments,

especially person-to-person and cross-border, faster, more seamless and

cheaper. He also recognizes that traditional financial services are

expensive and exclude many people who don’t have access to bank

accounts. Through services like those offered by his Estonia-based

fintech company, anyone with a mobile phone can open up a wallet and

immediately receive and make payments. “I think that’s amazing and the

borderless nature of cryptocurrencies is what makes it possible,” the

former Visa executive stated.

source link