Japan’s Consumer Affairs Agency (CAA) has released its 2019

report and noted a significant spike in inquiries concerning

cryptocurrency related issues last year.

The report details a 70%

increase in 2018 in regard to consumer queries largely stemming from

exchange issues. Moreover, over the last two quarters of 2019, the

Japanese yen paired with various cryptocurrencies like BCH and BTC has been climbing steadily, showing the country has a lot of demand for digital assets.

Also read: Policymakers Meet to Finalize Global Crypto Guidance – A Look at Standards G20 Supports

CAA Report: Crypto-Related Inquiries Spike by 70% in 2018

Over the last few years, Japan has been a hotbed for cryptocurrency

innovation. Things really started heating up after Japan’s Financial

Services Agency (FSA) officially announced that Bitcoin was recognized

as a legal method of payment on April 1, 2017. Since then, there have

been lots of crypto-related business developments, regulations formed,

and crypto exchanges

launched in the Pacific island nation. This week Japan’s Consumer

Affairs Agency (CAA) published its 2019 consumer affairs report which

touches upon inquiries and complaints surrounding the digital asset

industry.

The latest CAA report

has not yet been fully translated by the agency, but rough translations

reveal that in 2018 there were roughly 3,657 cases that were tethered

to cryptocurrency exchange complaints. The number represents a 70%

increase in contrast to the prior year when there were 2,166 queries and

complaints involved with digital currencies. The CAA has seen a

consistent increase in queries since 2014. For instance, the number

surpassed the previous year by 3.5X and 1.7X more than the year prior.

Lots of complaints and queries derived from exchange customers who had

issues receiving funds after paying and other complaints described

user-side hacks. Other inquiries asked the CAA about digital assets in

general and the credibility and reputation of certain exchanges.

Despite Increasing Crypto Regulation, Digital Assets Continue to Trend in Japan

In addition to this news, a recent study

from the Block’s Larry Cermak has shown that behind U.S. exchange

visitors, Japan leads with the world’s second highest traffic to

worldwide exchanges. According to Cermak’s data, the U.S. accounted for

24.5% of exchange traffic while Japanese visitors made up around 10% of

the traffic visiting crypto trading platforms. The trend has continued

to rise in Japan despite the regulatory climate changing in the country

on a regular basis. Japan recently passed a new cryptocurrency bill

which addresses transferring crypto assets, income taxes, and income

related transactions using digital currencies. A spokesperson from the

FSA described the new bill to news.Bitcoin.com in May. Moreover, on June 28-29, Osaka Japan will be hosting the V20 summit which will see well-known crypto businesses debate the proposed FATF international standards.

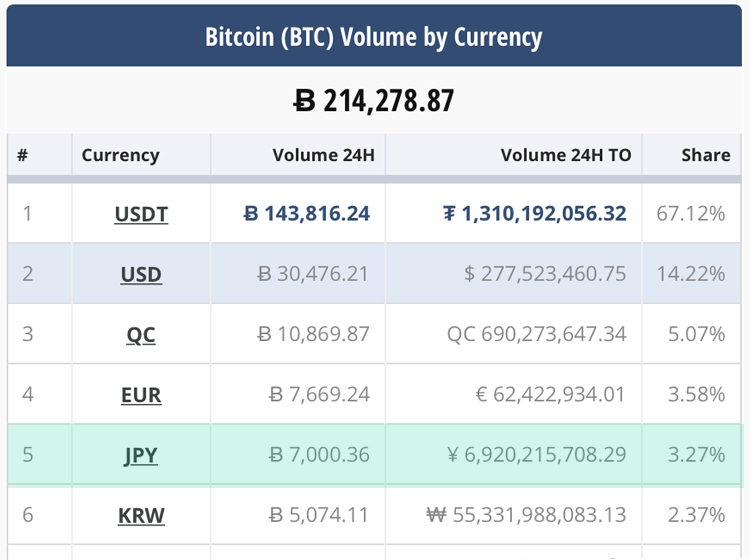

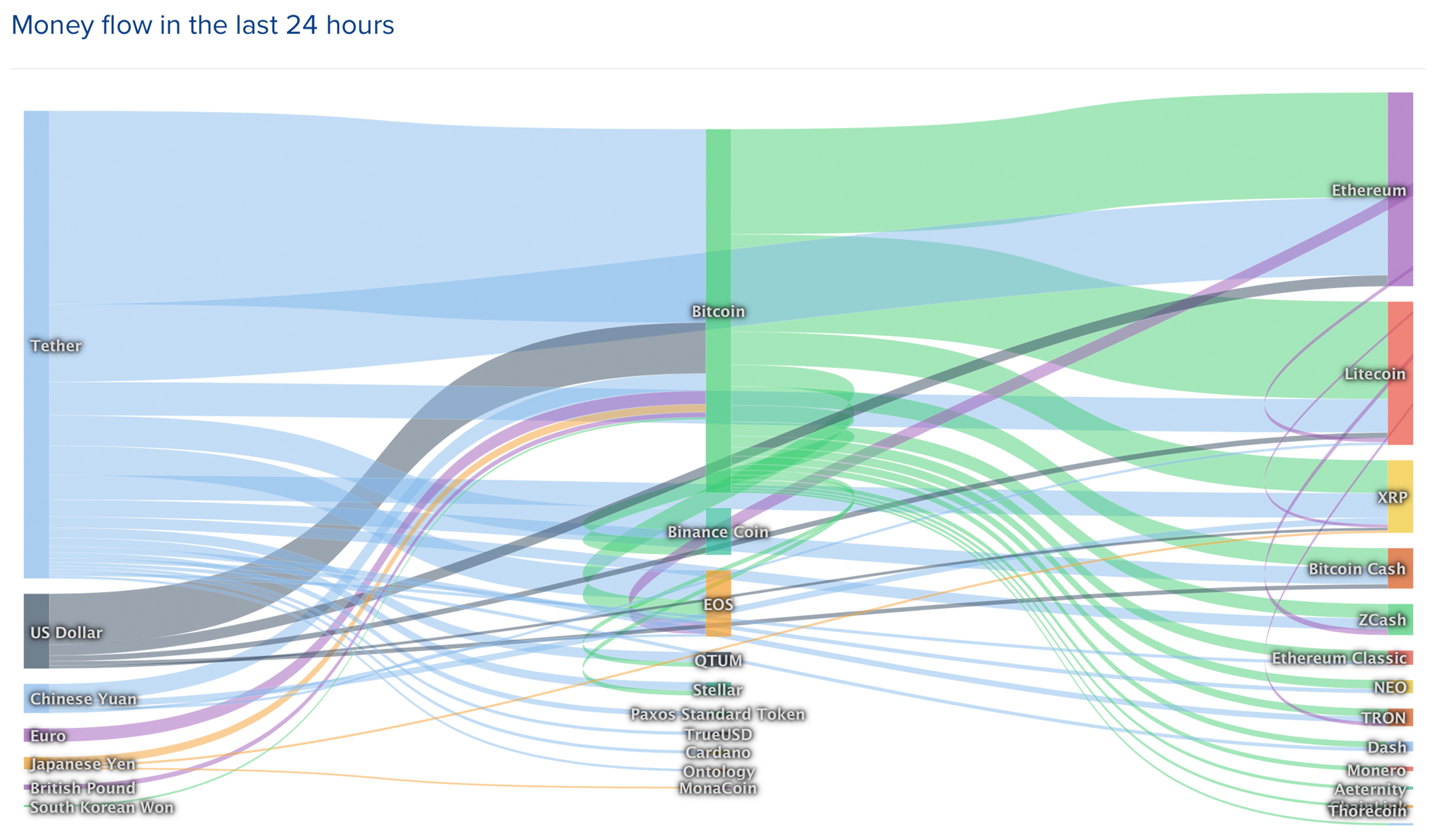

Despite all the regulation and FATF standards looming, the Japanese

yen has increased significantly when it comes to the global money flow

into digital assets. In 2017, the yen (JPY) was a top pair with cryptocurrencies like bitcoin core (BTC) throughout the crypto bull run. However, in 2018 the JPY against crypto pairs like BCH and BTC

dropped significantly as regulation spiked in the country and Coincheck

exchange was hacked. In the first six months of 2019 things have

changed drastically and the Japanese yen has gradually muscled its way

into the top five currency pairs against BTC and BCH.

Today JPY captures 4-5% of the global BTC trade volumes worldwide and 1-1.5% of bitcoin cash global trade volumes. This is a significant amount of volume comparatively seeing how most global crypto trade volumes are dominated by tether (USDT). The 70% increase in crypto-related queries reported by the CAA shows the trend in crypto interest continues to grow in Japan.

source link