Over the last seven days, decentralized exchange (dex) trade

volume has tapped $17 billion across the 21 Ethereum dex platforms.

Pancakeswap has seen between $400K to $860K every 24 hours during the

last week as well. Meanwhile, dex aggregators are eating away at dex

trade volumes, becoming more popular by the day.

Uniswap Commands Top Dex Trade Volume, Aggregation APIs Capture a 22% Share of Ethereum-Based Dex Volumes

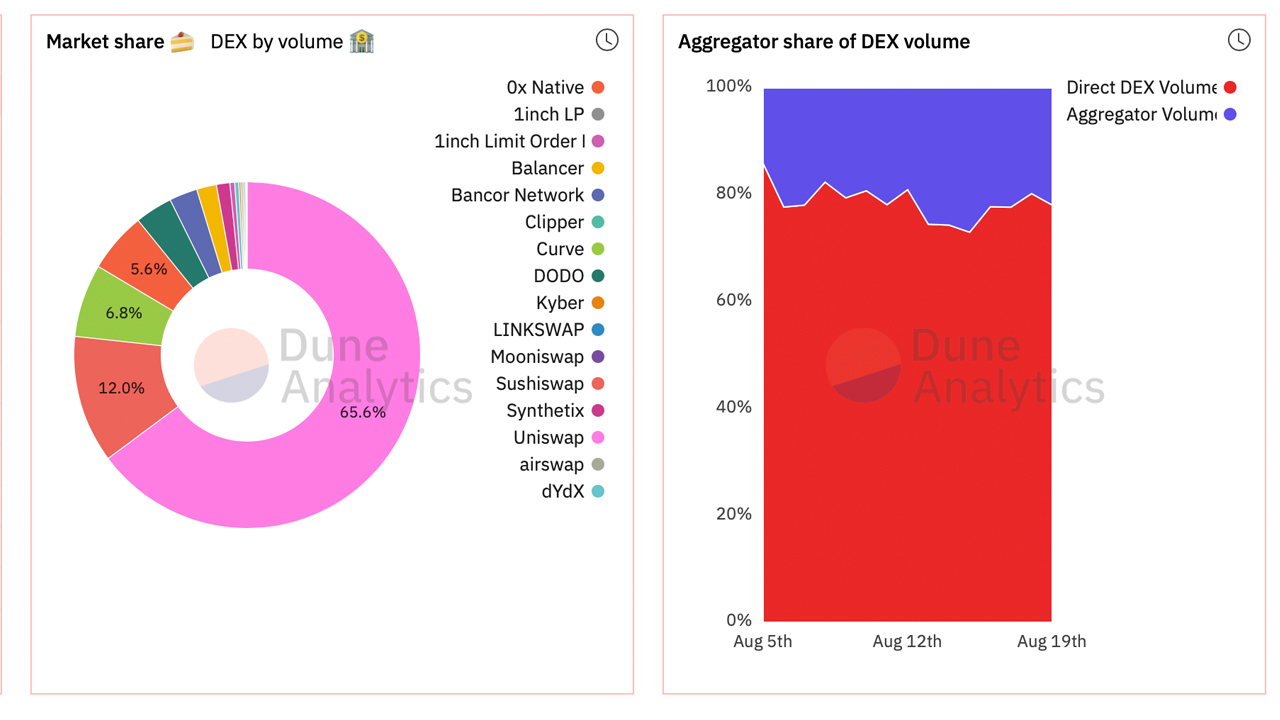

Decentralized exchange (dex) trading continues to see billions of dollars in swaps every week. During the last seven days, dex trade volume

has tapped $17 billion across 21 Ethereum-based dex platforms. Over the

last 24 hours, the 21 dex platforms saw $2.95 billion in global swaps

and dex aggregators captured $3.8 billion in 24-hour volume. Dex

aggregators like 1inch share around 22.7% of the dex trade volumes

today, according to stats from Dune Analytics.

Meanwhile, Pancakeswap, the Binance Smart Chain (BSC) dex, has seen between $400K to $860K every 24 hours during the last week as well. Some of the largest trading pairs on Pancakeswap on Thursday include CAKE, WBNB, ETH, and USDT.

Uniswap is the largest dex today out of the 21 Ethereum-based

decentralized exchange volumes recorded on Dune Analytics. Out of the

aggregate total of $17 billion, Uniswap captures 65.6% or over $11

billion in global swaps during the week.

Top Five Dex Aggregation Platforms Today Include 1inch, 0x API, Matcha, Paraswap, Tokenlon

Uniswap is followed by Sushiswap which captures $2 billion or 12% of

the seven-day dex trade volumes. Sushiswap is followed by Curve ($1.5B),

0x Native ($946M), Dodo ($585M), Bancor ($433M), and Balancer ($303M).

Seven-day statistics show that Uniswap has the highest number of traders

(or unique addresses) with 135,851 recorded on Thursday. This is

followed by 1inch (34,842), Sushiswap (22,820), 0x API (17,627),

Paraswap (5,297), and Matcha (4,154).

Aggregators have been eating into the trade volume as the platforms

allow users to choose between multiple dex protocols and search for the

best trades. Currently, the top dex aggregator is 1inch, followed by 0x

API. These two dex aggregation platforms are followed by Matcha,

Paraswap, and Tokenlon. This week, the top dex aggregator 1inch revealed it was introducing optimistic rollup technology to reduce fees and network congestion.

source link : https://news.bitcoin.com/weekly-defi-swaps-tap-17-billion-while-dex-aggregators-now-share-22-of-trade-volume/