154% in value since January 1. On August 18, Cryptovantage published a

study that shows 3 in 4 crypto investors said they had made money on

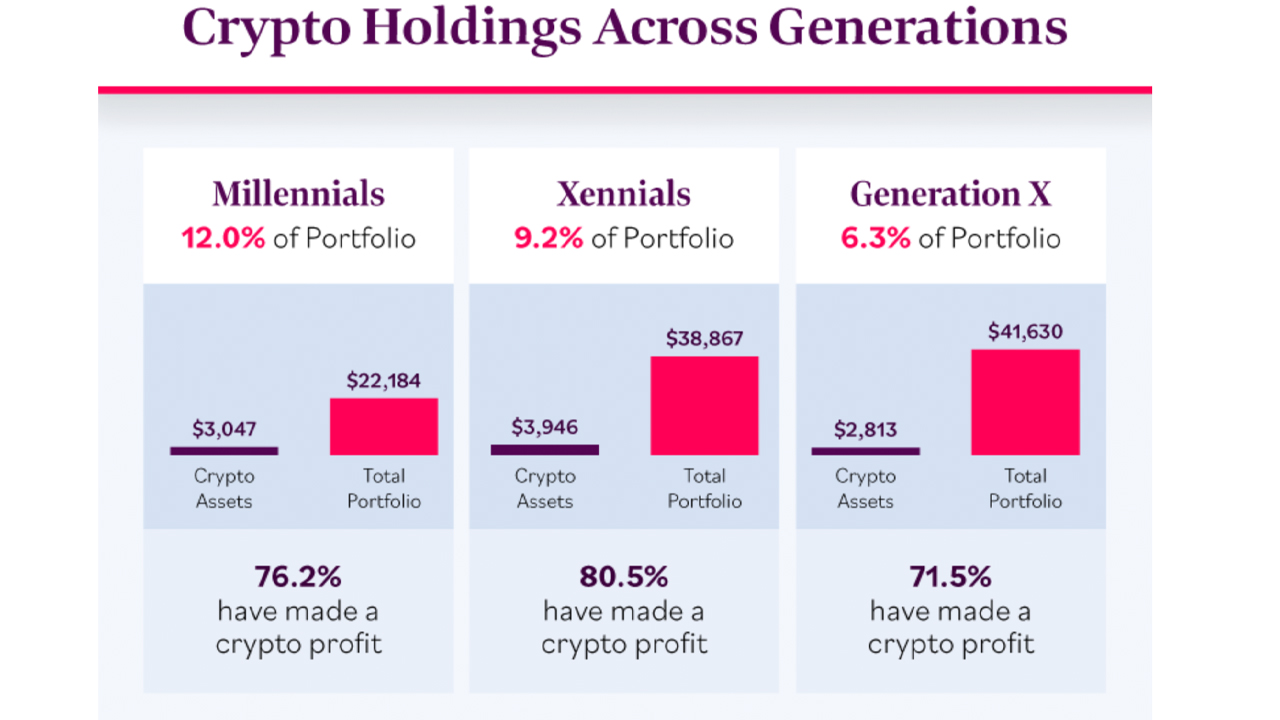

their crypto holdings and cryptocurrencies represent 12% of the average

millennial portfolio.

3 in 4 Digital Currency Investors Have Profited

Following the recently published research

by Cryptovantage concerning people forgetting their crypto passwords,

the company published another poll surveying 1,044 people born between

1965 to 1997. The poll explains how millennials, xennials, and Gen Xers

invest in digital assets. “The popularity of crypto assets varied by

age,” the new Cryptovantage report called “Generational Philosophies on Investing in Crypto,” explains.

“Crypto-assets represented 12% of the average millennial portfolio,

compared to 9.2% of the average xennial portfolio and only 6.3% of the

average Gen Xer portfolio,” the study details. “Despite this larger

proportional holding, millennials were not the most likely to report

making a profit in cryptocurrency investing. Xennials, with the largest

total investment, were the most likely to make a profit off crypto

assets at 80.5%, compared to 76.2% of millennials and just 71.5% of Gen

Xers.” The survey adds:

It’s worth noting that 3 in 4 people profited off cryptocurrency investments overall.

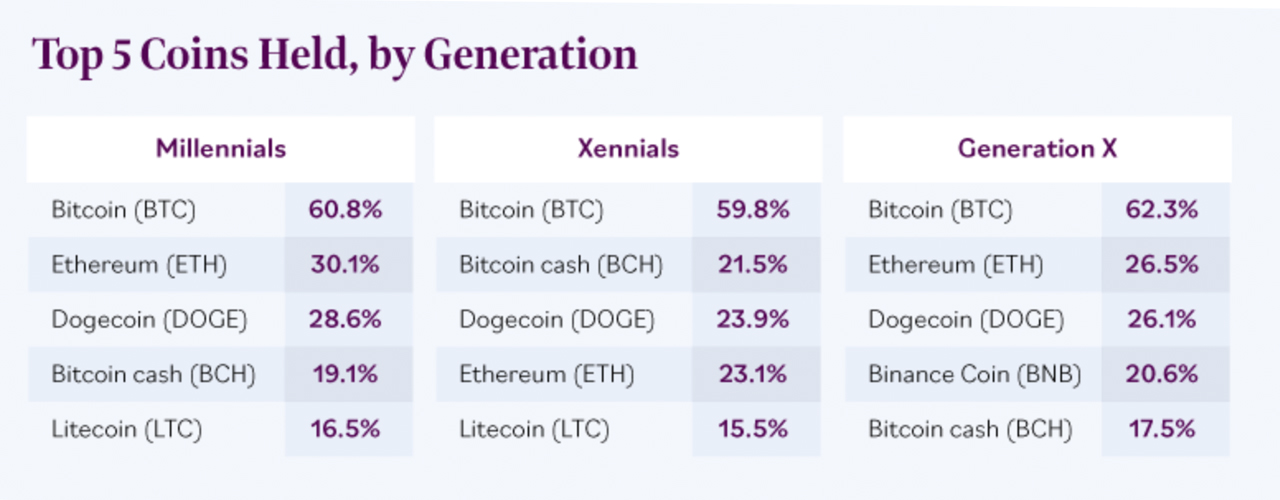

Bitcoin Is the Most Popular Digital Asset, Xennials Prefer Bitcoin Cash, Dogecoin

The survey indicates that across all the generational participants, bitcoin (BTC) was the most popular and besides BTC, Millennials and Gen Xers preferred ethereum (ETH). Xennials, on the other hand, chose bitcoin cash (BCH) and dogecoin (DOGE) over ETH. Most of the Millennials chose to leverage services like Coinbase and a number of xennials prefer services such as Bitcoin IRA.

While the report notes that the lion’s share of participants detailed

that “curiosity” was the main reason for investing, the second most

popular reason was for high profits. Roughly 39% of the 1,044

respondents also explained that Elon Musk was beneficial to the

cryptocurrency ecosystem.

“Xennials were the most likely to start investing in cryptocurrencies

because they believed they offer security and transparency and will

give them greater independence,” the Cryptovantage report author wrote.

“Gen Xers were the least likely to believe those same ideas; however,

they were more likely than both millennials and xennials to view cryptos

as the currency of the future.”