On Friday, the price of bitcoin jumped above the $49K zone

jumping 6.6% during the last 24 hours. 30-day statistics show the value

of bitcoin has swelled by 50% over the last month and many believe the

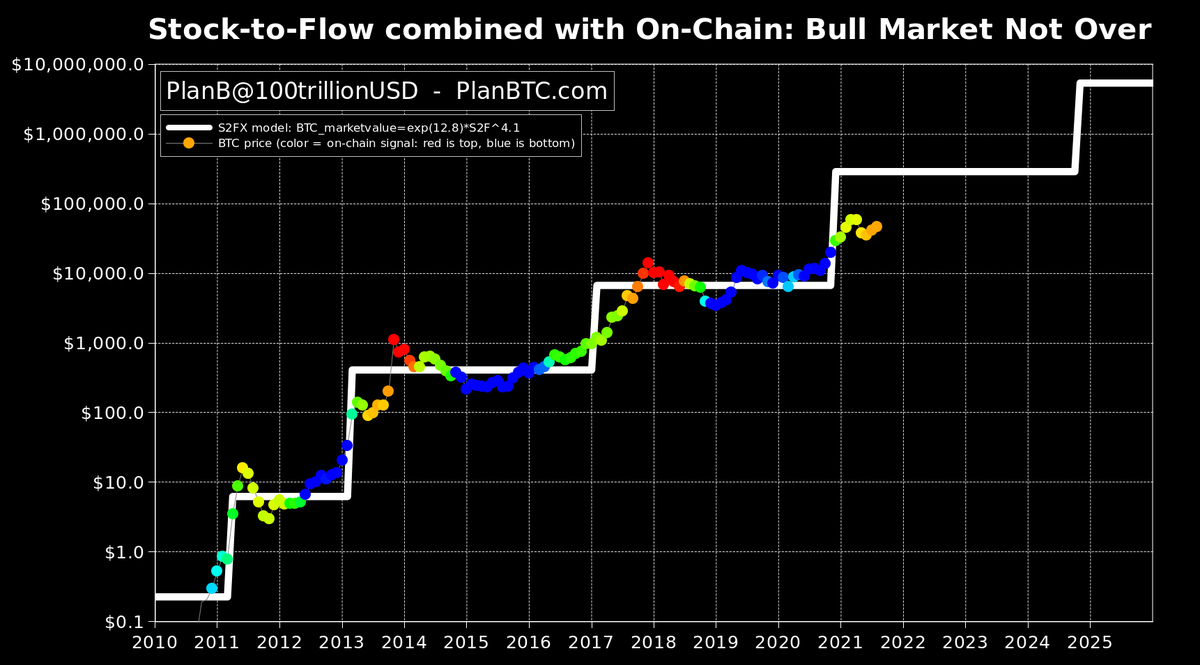

bull run is not over. Three days ago, the popular stock-to-flow (S2F)

creator Plan B shared an S2F chart that indicates a possible “2nd leg of

this bull market.”

Bitcoin Jumped Above $49K, Plan B Expects Another Price Jump

Bitcoin (BTC)

has gained over 6.6% today and jumped to a daily high of $49,164 per

unit at the time of writing. The leading crypto asset is up 51% since

last month and there’s $37.5 billion in global BTC trades today.

Last week, Bitcoin.com News reported on the stock-to-flow (S2F) creator Plan B

and how he explained that he was confident in his previous forecast.

Plan B stressed at the time that the “bull is not over and 64K was not

the top.” On August 17, Plan B also shared the same type of optimism.

“Both bitcoin S2F (white line) and on-chain signal (color, not red yet) still indicating a 2nd leg of this bull market,” Plan B wrote.

Following this statement, Plan B was asked: “Are we shooting for $288k

again? Or still $100k? I’m confused.” The S2F analyst replied and said:

IMO we are going up, first to 100k, then 288k.

Onchain Data Shows Bitcoin Accumulation

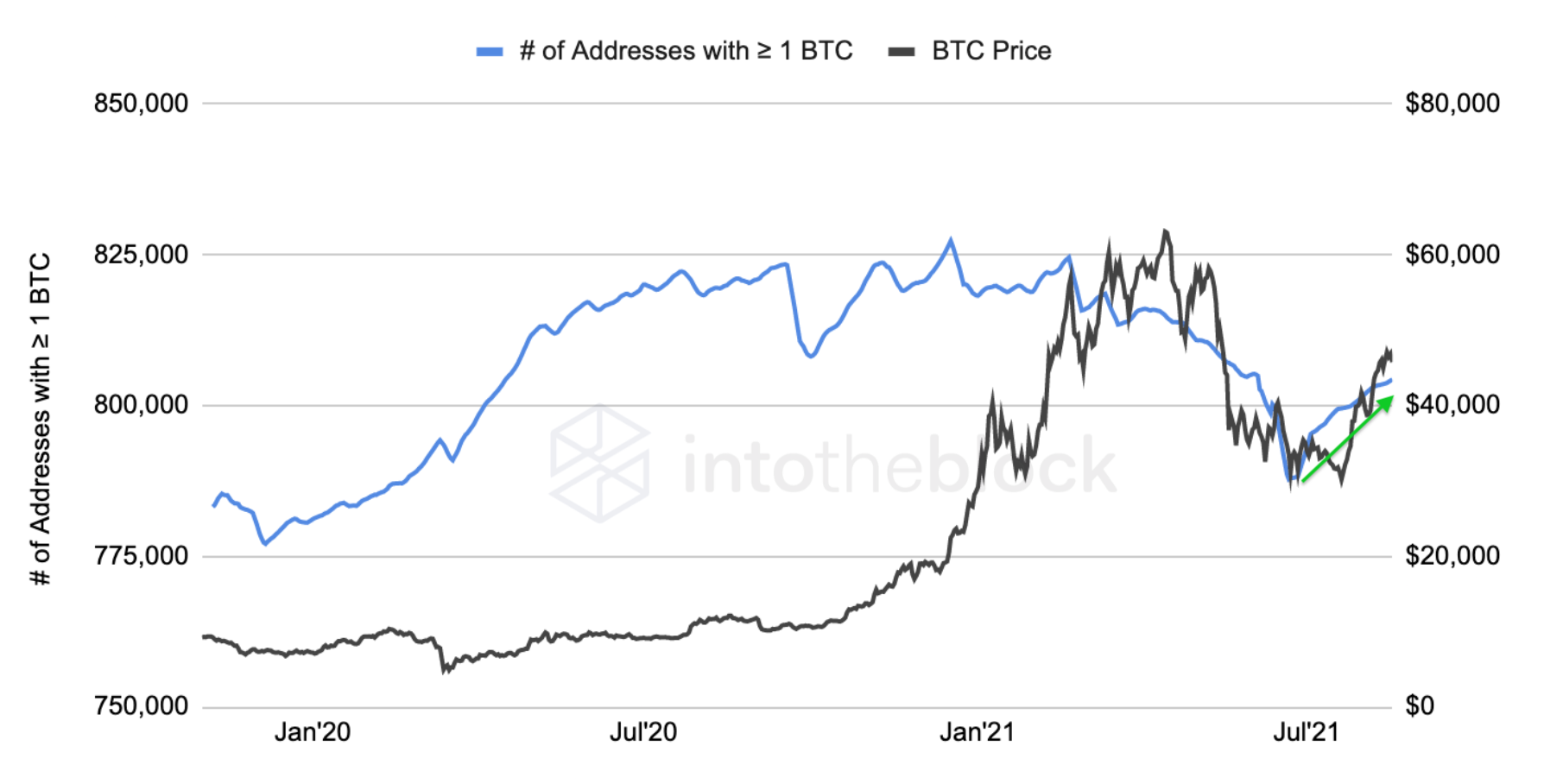

Onchain data currently shows there’s been a lot of bitcoin (BTC) accumulation according to Intotheblock’s (ITBs) 50+ onchain indicators.

“Since February 2021, the number of addresses holding at least one

bitcoin declined by 40,000, beginning when prices first reached $50,000

and accelerating in June as prices dipped below $30,000,” Intotheblock’s

onchain insights detail. “This likely shows addresses first taking

profits and then potentially some of the panic-selling into the crash,”

the researchers added. The Intotheblock research team further said:

This trend has taken a quick turn in the opposite

direction as the number of addresses holding one or more bitcoin is back

above 800,000, pointing to renewed interest and accumulation of holders

to reach a full bitcoin. A similar pattern can be observed in the

volume held by addresses with over 1,000 bitcoin.

In the same Twitter thread, Plan B was asked

“why people [are] still saying it’s a bull, while 90% of the traders

are [at a] loss?” Plan B responded and said: “[Bitcoin] is up 4x since a

year ago, investors are in profit. 90% of traders are always in loss in

any market because they trade too much and are killed by cost, or they

have no system and are killed by emotions, or they are killed by hedge

fund trading desks. Odds are against trading,” the analyst concluded.

source link : https://news.bitcoin.com/s2f-creator-envisions-a-2nd-leg-of-this-bitcoin-bull-market-onchain-data-shows-btc-accumulation/