During the last few weeks, a crypto asset called solana has been

making its way up the charts and has made it into the top ten

cryptocurrencies by market capitalization. Solana reached an all-time

price high on Monday, capturing $74 per unit and an 80% gain over the

course of the week. In addition to the fresh price highs, the Solana

ecosystem has grown significantly with more than 300 projects leveraging

the system

Solana Captures an All-Time Price High

The crypto asset solana (SOL)

has made it into the top ten cryptocurrencies in terms of market

valuation on Monday. The digital currency SOL reached an all-time high

(ATH) as well that day, when it jumped above the $74 handle. According

to statistics, during the course of the seven trailing days up until

Monday, SOL jumped over 80% in a week, 109% over the last two weeks, and

160% in the last month. Against the U.S. dollar, SOL has gained

1,960.5% during the trailing 12-month period.

Solana’s official Twitter page has 393.4K followers and Google Trends data shows the search query worldwide has jumped in recent times. The project’s website solana.com

claims developers can “build crypto apps that scale” and says “Solana

is a fast, secure, and censorship-resistant blockchain providing the

open infrastructure required for global adoption.” The Solana network is

not like Bitcoin (BTC) which uses proof-of-work (PoW) for consensus.

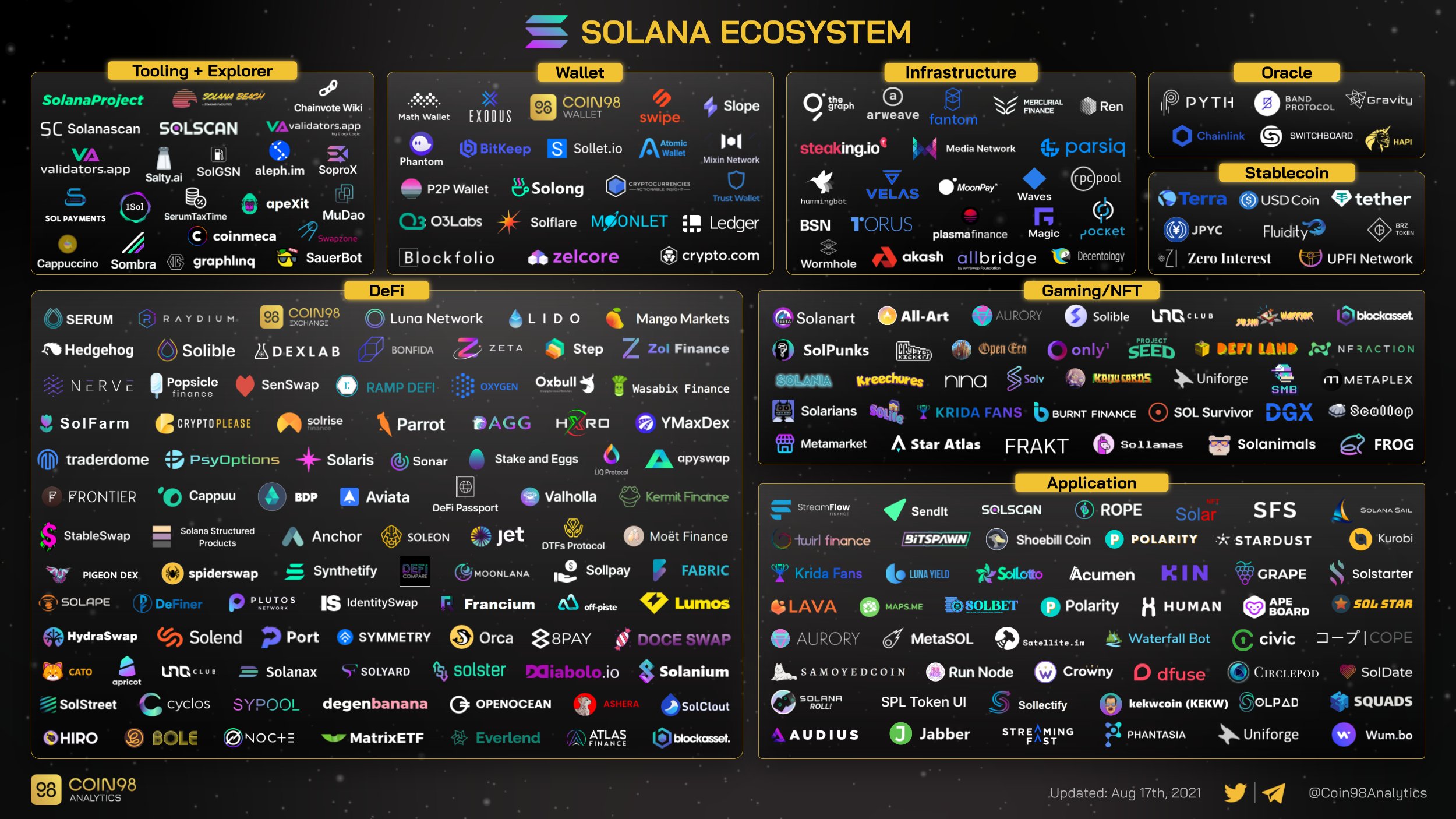

Quite a few projects are utilizing the Solana blockchain, as a tweet from Coin98 Analytics

shows the Solana protocol is leveraged by over 300 different projects.

Solana comprises a system of 200 nodes that support significant

throughput and a consensus method called proof-of-history.

The founder and CEO of Solana, Anatoly Yakovenko, believes that “Solana outpaces the Bitcoin, Ethereum, Libra, Tendermint, and Algorand blockchain networks.”

“Whereas other blockchains require validators to talk to one another

in order to agree that time has passed, each Solana validator maintains

its own clock by encoding the passage of time in a simple SHA-256,

sequential-hashing verifiable delay function (VDF),” Yakovenko explains.

The Solana founder’s blog post about the subject adds:

This differs from the current standard of blockchain

infrastructure, which relies on a sequential production of blocks that

are hindered by waiting for confirmation across the network before

moving forward. Proof of History presents a fundamental move forward in

the structure of blockchain networks in regards to speed and capacity.

$20 Billion Market Cap, Solana Mainnet Stops Producing Blocks on December 4, 2020, for 6 Hours

Solana says it can process 50,000 transactions per second and fees are about $0.00025 per transaction.

SOL’s market valuation on August 16 is over $20 billion, and the crypto

asset has a circulating supply of around 286,294,787 coins. SOL’s top

trading pair is tether (USDT), capturing 50.3% of swaps and is followed by the U.S. dollar, commanding 23% of trades. These are followed by BTC (12.12%), BUSD (7.25%), ETH (2.97%), and TRY (1.41%).

Solana has also had some hiccups along the way. In December 2020, a

blog post detailed that the protocol’s mainnet stopped producing blocks.

“At approximately 1:46 p.m. UTC on December 4th, 2020, the Solana

Mainnet Beta cluster stopped producing blocks at slot 53,180,900, which

prevented any new transactions from being confirmed,” the team detailed.

source link : https://news.bitcoin.com/solana-captures-fresh-all-time-highs-sol-joins-top-ten-crypto-assets-by-market-cap/