Hydra chain,

a new Proof of Stake blockchain emerged earlier this year and built by

combining the best features of Bitcoin, Ethereum and Qtum chains,

announced the launch of its native DEX this week.

By taking this step, Hydra joins the ranks of only a handful of blockchains that offer DEX capability (Ethereum, BSC, Polygon, EOS, Tron, Solana and now also Hydra).

Will Hydra become the next big thing?

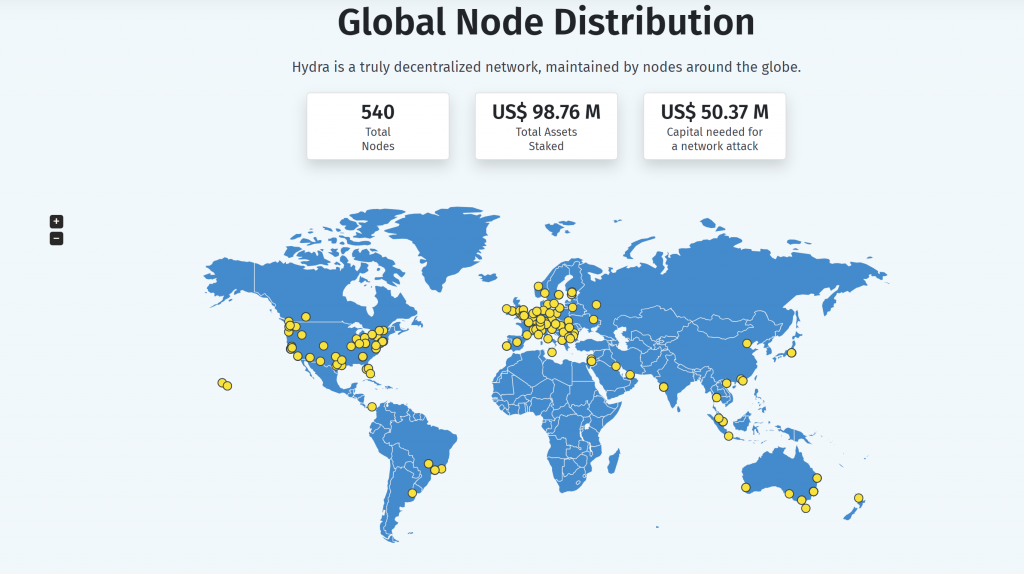

Hydra

was launched in late 2020 and has since grown by more than 1,000% in

price. Through its multiple campaigns the chain quickly established a

strong node infrastructure and now counts more than 500 validators

across the globe.

Stakers currently enjoy an APR of around 80% – which the team behind Hydra calls the “seed phase incentive” for early adopters.

In the few months since its

inception, the ecosystem has grown considerably, with five projects

already being built on the Hydra chain right now:

- LockTrip (blockchain-based travel marketplace with up to 60% discounts on hotels)

- GoMeat (speciality meat delivery application – currently during its ICO stage)

- Evedo (online ticketing platform for some of the biggest events worldwide)

- Rezchain (blockchain based booking verification technology of Webjet – the second biggest travel supplier in the world)

- Hydra DeFi ecosystem

But the ambitions seem not to stop there.

Why the Hydra DEX is about to Supercharge the Ecosystem

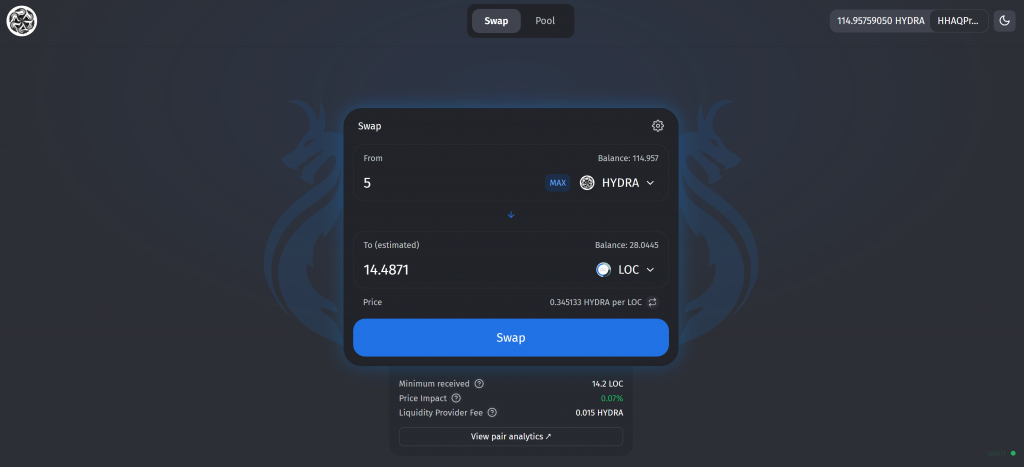

The community has long anticipated the launch of the DEX,

as it represents a critical milestone in the development roadmap of the

ecosystem. Through it, projects can now create strong liquidity pools

and improve the trading experience considerably. Hence new projects

launching on the Hydra chain will have a much easier path to success –

by accessing the global liquidity and financial markets within a few

clicks.

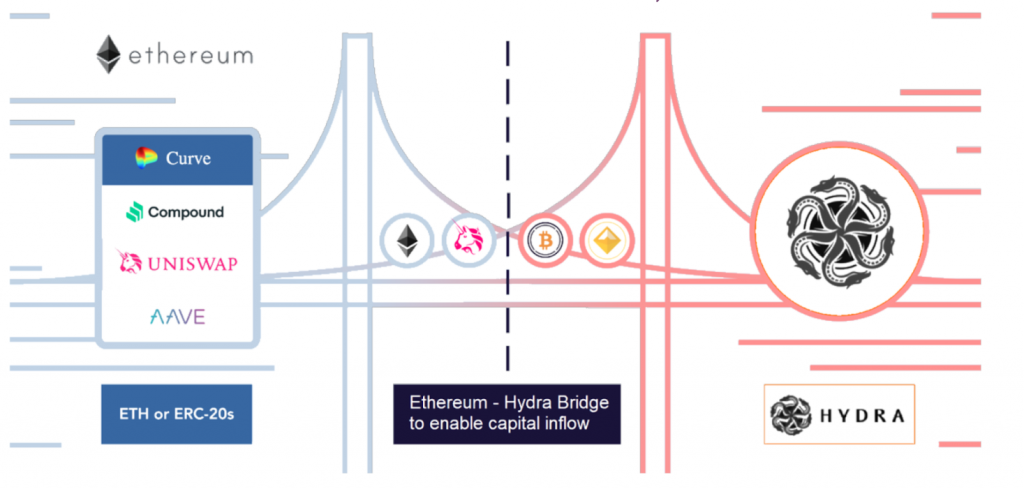

While this is great news for more

projects joining the ecosystem, the team behind Hydra has also a plan

for existing projects that are currently on alternative chains such as

Ethereum and BSC.

A new application called the “Hydra Bridge”

is currently being built and aims to create a single click cross-chain

gateway between Hydra and Ethereum. In parallel to this, a targeted

liquidity mining program is being designed which has the capability to

significantly boost the APR on Hydra-based liquidity pools. High APR

pools have historically been very successful in attracting capital.

The combination of the bridge with

the liquidity mining program is thus expected to lead to a steady flow

of capital from the currently popular chains towards Hydra –

strengthening its position in the global markets.

The Holy Grail of the DEXes

Current DEX applications such as

Uniswap or Pancakeswap all share one common and very serious problem.

Since traders directly interact with the liquidity pools, the balances

of the two sides of a pool are constantly subject to change – and thus

liquidity providers who aim to profit from the trading fees have a high

risk of ending up with a different asset combination than they initially

deposited.

The main problem however is that this

risk is not random – but systematic instead. Which means that liquidity

providers are always on the losing side. The question is not IF they

lose, but how much. And whether the trading fees are able to compensate

for the losses.

This phenomenon is called impermanent

loss and is commonly known among liquidity providers. The team behind

the Hydra DEX claims to be working on a solution against impermanent

loss. If the end result works that way, then Hydra DEX could very well

take a leading role in the space. Will they capture the “Holy Grail” of all DEXes? Time will tell!

Single-Sided Liquidity

Another issue that plagues liquidity

providers is that with most DEX applications, you can only deploy both

sides of the pool simultaneously. Thus the LP needs to invest into both

assets – and carry double the exposure. Hydra DEX claims to have found a solution to this problem, although the team keeps their cards well hidden for now.

If successful, this could unlock

plenty of potential as holders of various tokens and coins could put

their assets to work without having to worry about the other side of the

pool. Especially when it comes to stablecoins and fixed-supply tokens, a

relatively low APR of 5-10% could appear highly attractive to the

crypto community.

What do you think about the potential

of the Hydra chain? Will it be able to break into the top places by

following this strategy? Share your thoughts in the comments section

below.

You may also join the Hydra community to engage directly with the core team members.

source link : https://news.bitcoin.com/hydra-chain-claims-its-spot-by-launching-a-native-dex/