Donald Trump boosts markets with improving health prospects, but coronavirus is taking its toll — Bitcoin eyes macro moves.

Bitcoin (BTC)

rose to highs of $10,730 before settling lower on Oct. 5 as markets

fluctuated in line with United States President Donald Trump contracting

COVID-19.

Cointelegraph takes a look at the factors set to

influence BTC price action this week, as the virus and its consequences

dictate the macro mood.

Trump health sends markets higher

President

Trump buoyed markets late Sunday as traders priced in the possibility

that he would leave hospital on Monday after treatment for COVID-19.

Futures

were up, reversing losses on Friday, along with major stock markets

including the S&P 500, to which Bitcoin continues to show high

correlation.

Trump’s coronavirus diagnosis had caused modest panic

late last week, with stocks diving and BTC/USD reacting in kind,

dropping from $10,940 to lows of $10,380.

“It’s been a really interesting journey; I learned a lot about Covid,” Trump said in a video update

posted to Twitter late Sunday, apparently addressed to a crowd of

supporters situated outside his hospital prior to a surprise

meet-and-greet:

“I learned it by really going to school —

this is the real school; this isn’t the ‘let’s read the book’ school,

and I get it, I understand it. It’s a very interesting thing and I’m

going to be letting you know about it.”

Wall Street had

yet to open at publishing time, with resumption of trading set to

dictate further market trajectory for the start of the week.

BTC/USD vs. S&P 500 one-year chart. Source: Skew

Cineworld shares drop 56% on coronavirus shutdown

Beyond Trump, coronavirus continues to create uncertainty in the U.S. and abroad.

New

York continued with phased infrastructure shutdowns on Monday, while in

Europe, the worsening infection rate caused Paris to close certain

establishments.

In a fresh toll to business, meanwhile, Cineworld,

the world’s second-biggest movie theater chain, said it would close its

entire operation in both the U.S. and United Kingdom until further

notice from Oct. 8. Its shares subsequently plunged 56% to a new all-time low.

Nevertheless,

rumors abound that Trump’s situation may in fact spur both political

sides in Washington to reach a stimulus deal, something which would have

an immediate impact on markets.

As Cointelegraph reported,

Treasury Secretary Steven Mnuchin had already alayed fears of a

continued stalemate by confirming that whatever happens, the package

would include another $1,200 stimulus check for eligible Americans.

The

long-term impact of state-sponsored income is in itself controversial,

with commentators previously arguing that once implemented, the checks

would be difficult to simply “turn off.”

At the time that the first round of checks hit in April, cryptocurrency exchanges noticed increased volume specifically for the amount of the $1,200 payouts.

BTC/USD one-week chart. Source: Coin360

Brexit deadline looms… again

Europe’s

turn in spotlight when it comes to macro market movements may lie ahead

of it, as last-minute intense talks over Brexit got underway Monday.

Long

a contentious issue for the British pound and its traders, the Brexit

deal — or lack of it — has previously even managed to produce knock-on effects for Bitcoin.

This

time around, the talks aim to produce a compromise before a crucial

European Union meeting on Oct. 15, with a realistic deadline to produce

consensus now set for sometime in early November.

Asked what the

impact of no deal would be, U.K. prime minister Boris Johnson told a BBC

radio show that the country “could more than live with it.”

In

London, FTSE 100 futures were nonetheless up on Monday, more than

reversing their losses from throughout the previous week’s trading.

Along with Brexit, as Cointelegraph noted,

the Bank of England is currently researching the idea of introducing

negative interest rates for the first time in its history.

Bitcoin difficulty, hash rate come down from peak

Recent selling pressure meant that Bitcoin’s fundamentals were unable to continue their record winning streak.

Difficulty,

perhaps the most important measure of miner health, barely moved at its

latest readjustment on Oct. 4. Previously, estimates suggested that the

metric would build on existing all-time highs to shoot higher still.

In the event, a 0.09% dip extinguished optimism, which was running high after the previous readjustment saw an 11.35% uptick.

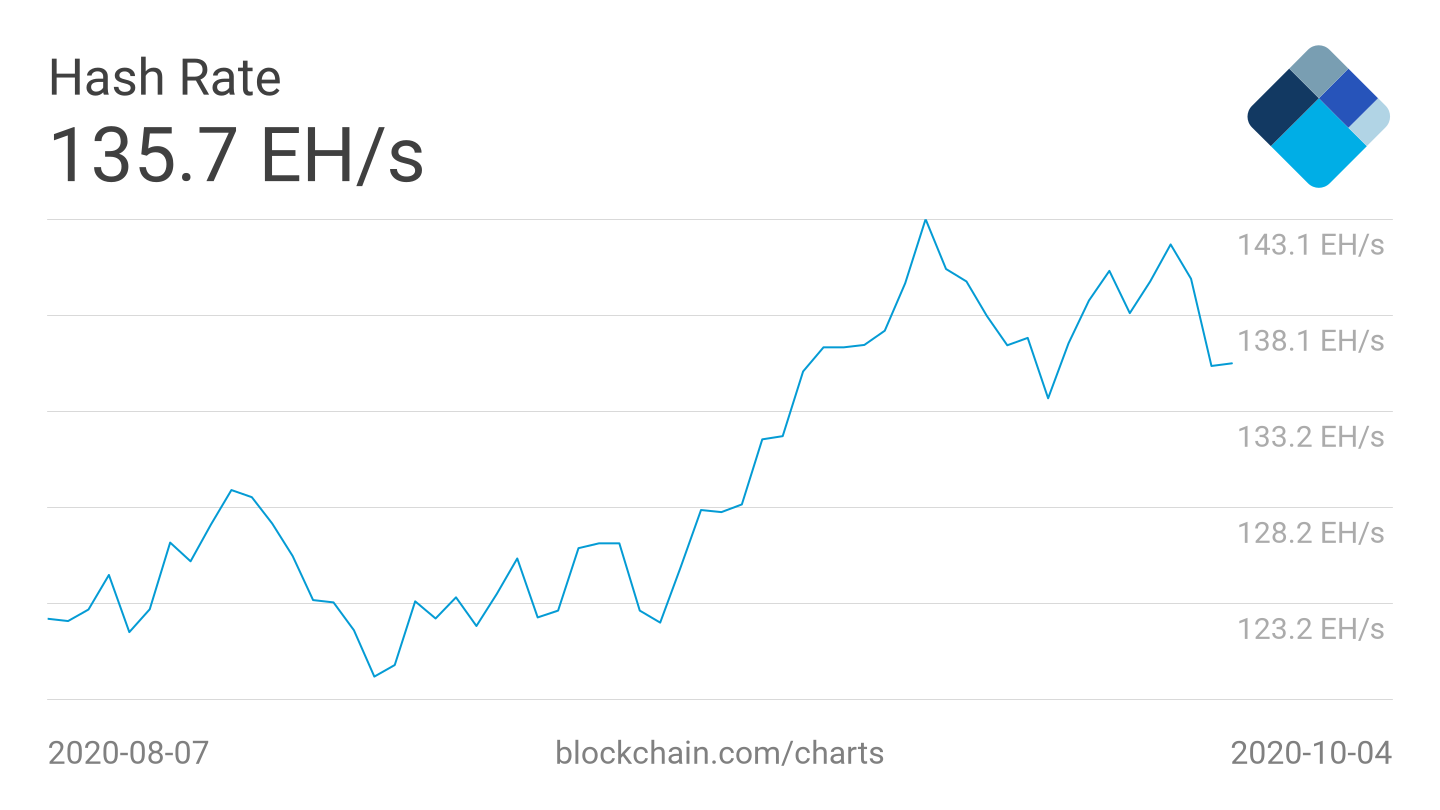

Hash

rate, a measure of the computing power dedicated to validating the

Bitcoin blockchain, was also flat on Monday, hovering at 135 exahashes

per second (EH/s).

Seven-day hash rate highs had reached a record 143 EH/s in September, with another surge to 141 EH/s on Oct. 1.

Bitcoin seven-day average hash rate two-month chart. Source: Blockchain

As Cointelegraph reported, another difficulty metric, Difficulty Ribbon Compression, showed a much more bullish trend last week.

PlanB on stock-to-flow: Time for divergence

Zooming out, Bitcoin analysts appeared as satisfied as ever with the largest cryptocurrency’s performance.

For

quant analyst PlanB, creator of the stock-to-flow family of BTC price

models, it was now time for Bitcoin to follow its historical trend and

put in fresh gains.

The impetus was the 200-week moving average (200WMA), which on Oct. 4 reached a new all-time high of $6,800.

A favored price feature for PlanB, the 200WMA has never been broken in price downtrends, and currently increases by around $200 each month. Analyzing the latest data from stock-to-flow, PlanB summarized on Twitter:

“Time for the red and orange dots to divert from 200WMA again.”

Such

behavior, where the dots represent BTC/USD according to its distance

from halving events, has repeated following both the 2012 and 2016

halvings.

Bitcoin stock-to-flow chart as of Oct. 5. Source: PlanB/Twitter

source link : https://cointelegraph.com/news/trump-price-dots-and-covid-19-5-things-to-watch-in-bitcoin-this-week