U.S. equities markets jumped on Thursday as stock traders saw

some relief after a number of weekly losses. All the major stock

indexes rebounded after falling for nearly eight weeks in a row, while

the crypto economy took some losses on Thursday, losing roughly 4%

against the U.S. dollar during the past 24 hours. Meanwhile gold has

been hanging below the $1,850 per ounce mark as Kitco’s Neils

Christensen says gold markets remain “under pressure, seeing no major

buying momentum.”

Analyst Says ‘Doom and Gloom’ Predictions ‘May Have Been Overdone’ Amid Stock Market Rebound

The Dow Jones Industrial Average, S&P 500, the Nasdaq, and NYSE composite all rallied

during Thursday’s trading sessions. The S&P 500 rose about 2%

reaching 4,057.84 by the closing bell, while Nasdaq spiked 2.7%, hitting

11,740.65.

The Dow Jones jumped around 1.6% on Thursday afternoon, as the index

recorded gains for the fifth straight day in a row. Quincy Krosby, LPL

Financial’s chief equity strategist, believes the rebound may be a sign

that some of last week’s doom and gloom predictions were overhyped.

“Although this was an expected, and highly talked about potential

‘oversold’ rally, the underpinning for today’s market climb higher,

suggests that last week’s doom and gloom about the all-important U.S.

consumer may have been overdone, along with the dire recession

headlines,” Krosby told CNBC’s Tanaya Macheel and Jesse Pound on Thursday.

Many Believe Cryptos Have Decoupled, Alex Krüger Says ‘Worst Case Scenario for Crypto Is Here’

Meanwhile, amid the equities rebound, the cryptocurrency economy faltered again on Thursday, losing 4% during the past 24 hours of trading. Bitcoin (BTC) lost a small percentage on Thursday dropping roughly 0.7%.

Ethereum (ETH),

however, lost around 6.9%, alongside a number of alternative crypto

assets that saw deeper losses than bitcoin. While stock markets have

improved and crypto assets have not, a number of traders have been

discussing crypto decoupling from stocks in terms of correlation.

The economist and trader Alex Krüger spoke about crypto decoupling from stocks on Thursday.

“Worst case scenario for crypto is here,” Krüger said.

“Apathy and decoupling. The correlation with equities is now broken.

It’s been largely gone since Monday afternoon. Now equities bounce

alone.” After his statement, Krüger doubled down on his commentary.

“Watch people who don’t trade and barely watch charts or correlations

disagree with this tweet. It’s ok. Everybody copes differently,” Krüger added.

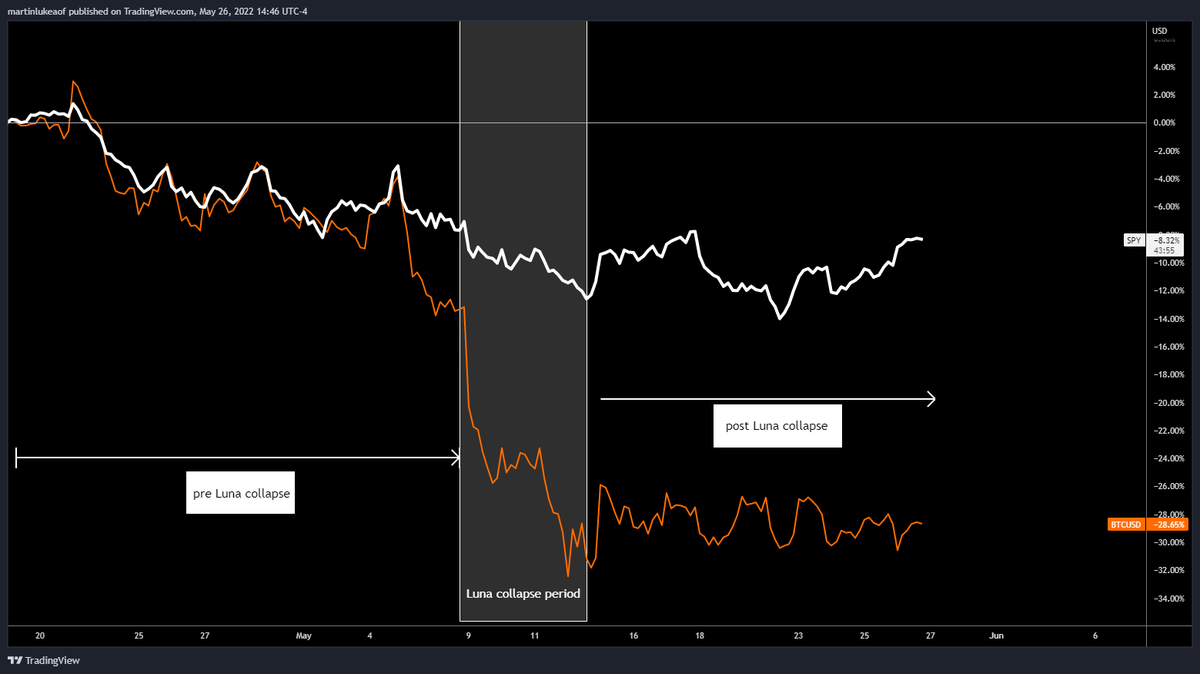

The bitcoin proponent Luke Martin, host of the Stacks podcast, also talked about digital currencies not bouncing back with equities markets.

“Seeing lots of tweets about stocks [and] crypto decoupling, and

crypto not bouncing with stocks,” Martin tweeted. “Charting gives a

better picture of what’s happening: 1/ We had high correlation 2/ Luna

collapse leads to more severe crypto selloff 3/ Post collapse crypto not

making up the difference.”

As Gold Markets Slump, Peter Schiff Discusses the US GDP Contraction and Bitcoin’s Decoupling

Gold has also not increased in value and remains under the $1,850 per

ounce price range against the U.S. dollar. 30-day statistics show an

ounce of fine gold is down 1.67% and 0.27% was lost during the past 24

hours. On Thursday, Kitco’s Neils Christensen

discussed gold’s slump in a report that highlights the recent U.S.

Commerce Department report that notes the first-quarter gross domestic

product (GDP) declined at a 1.5% annual rate. “The gold market is not seeing much reaction to the disappointing economic data,” Christensen explained on Thursday.

Gold bug and economist Peter Schiff talked about the GDP shrinking 1.5% and also mentioned that bitcoin (BTC)

has decoupled from Nasdaq. “The U.S. economy, supposedly the strongest

it’s ever been, contracted by 1.5% in Q1, .2% more than analysts

expected,” Schiff said

on Thursday. “If [the] GDP contracts again in Q2, then the economy is

officially in a recession. If GDP contracts when the economy is so

[strong], imagine what happens when it’s weak,” the economist added.

Schiff continued on Thursday and made sure to throw salt on bitcoin’s recent market wounds. Schiff remarked:

Is bitcoin finally breaking free of its high correlation

with the Nasdaq? While tech stocks are rising today Bitcoin is falling,

almost breaking below $28K. My guess is that Bitcoin will continue to

maintain its positive correlation with the Nasdaq, but only when it’

source link : https://news.bitcoin.com/while-stocks-rebound-analysts-discuss-bitcoins-decoupling-gold-markets-remain-under-pressure/