Global markets have been feeling the pressure of fear and

uncertainty, as the upcoming Federal Open Market Committee (FOMC) plans

to make a decision on Wednesday concerning changing the current monetary

easing policy and raising the benchmark interest rate. Economists and

market analysts fear the hawkish Federal Reserve will tighten markets

too fast after the central bank expanded the U.S. monetary supply like

never before in history.

Allianz Chief Economic Adviser: ‘Fed Maintained Its Transitory Inflation Narrative for Way Too Long’

All eyes are on the Federal Reserve this week and the conversation has turned into speculation

about the upcoming FOMC meeting. The committee will make a decision on

Wednesday at 2 p.m. (EST) which will be followed by a press conference

from the central bank chairman Jerome Powell. Last week global stocks

were roiled and dropped significantly, while crypto markets followed the

same path as the crypto economy shed billions in value. Precious metals like gold and silver managed to stave off the market rout, and both metals are up a few percentages over the last 30 days.

Federal Open Market Committee (FOMC) plans to meet on Wednesday, and

market participants are expecting a shift in monetary policy. Federal

Reserve chair Jerome Powell (pictured above) will hold a press

conference after the FOMC meeting at 2:30 p.m. (EST) on January 26.

As the U.S. central bank has hinted at tightening quantitive easing (QE) and raising interest rates, the Fed’s critics believe the pivot is too fast.

Mohamed El-Erian, the chief economic adviser at the financial services

company Allianz, is one of those critics. “The first policy mistake was

completely misunderstanding inflation,” El-Erian said on Tuesday. He

added that the Fed’s Board of Governors “maintained its transitory

inflation narrative for 2021 way too long, missing window after window

to slowly ease its foot off the stimulus accelerator.”

Now that the Fed seems to be moving in the direction of tightening

monetary easing quickly, traders and analysts are fearful about creating

new positions in the market. “I would be very [reluctant] to look at

getting in or adding to positions to anything until we hear from an

increasingly hawkish Fed on Wednesday,” the managing director at

Strategic Funds, Marc LoPresti, told the press on Monday.

Market Participants Try to Predict the Fed’s Monetary Tightening Timeline

Meanwhile, as the FOMC meeting has been trending on social media and forums, analysts have been trying to predict the decision ahead of time.

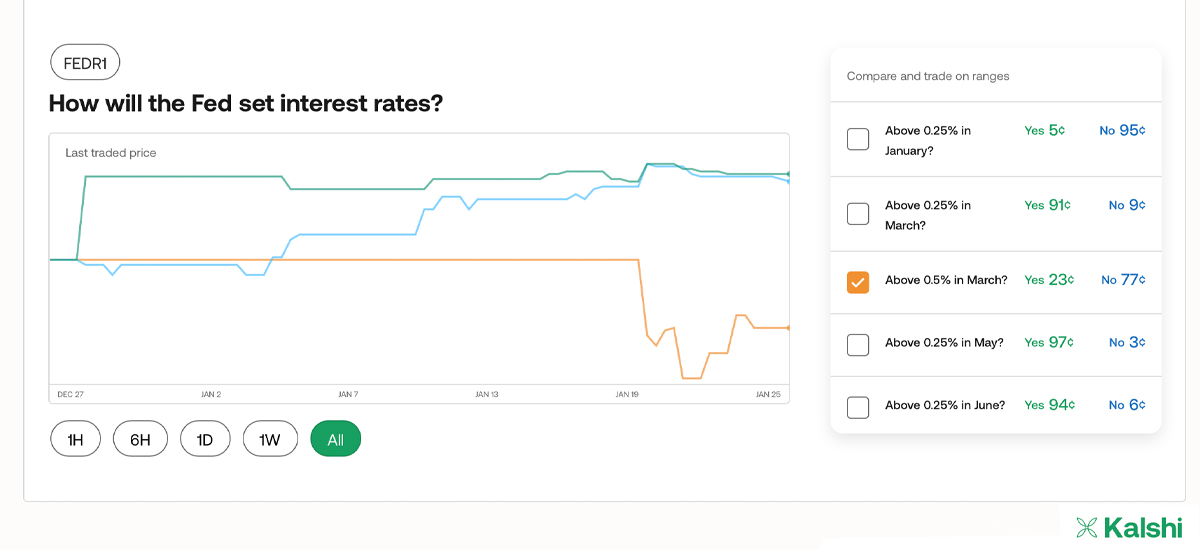

The prediction markets operated by kalshi.com are also trying to forecast

when the U.S. central bank will raise the benchmark rate. 98% of those

leveraging kalshi.com’s Fed prediction market say the Fed will raise the

rate above 0.25% in July.

The least-chosen month was December 2022 and 84% chose that specific

date. The financial analyst on Twitter that goes by the name “Mac10,” explained that market bulls need to break their strength.

“The way I see is that either the market crashes between now and FOMC, forcing the Fed to reverse,” Mac10 wrote.

“Or, the Fed comes in hawkish and the market crashes. I don’t see a

Goldilocks scenario. Bulls, something must break for the Fed to reverse.

That something is you.”

UBS Executive: ‘This Week’s Fed Meeting Is Likely to Underscore the Fed’s Shift in Policy Priorities’

Mark Haefele, CIO of Global Wealth Management at UBS, thinks the

upcoming Fed meeting will “underscore” the Fed’s current line of

thinking.

“For much of the past decade, market volatility was calmed by the

notion that the Federal Reserve and other global central banks stood

ready to step in to support the economy in the event of weakness,

exogenous shocks, or an unexpected tightening in global financial

conditions,” Haefele said

in a statement on Tuesday. “Today, with inflation still elevated, that

support feels less certain, and this week’s Fed meeting is likely to

underscore the Fed’s shift in policy priorities away from supporting

growth and toward fighting inflation,” Haefele added.

Metrics recorded 24 hours before the FOMC meeting show that stock

markets saw some relief at the end of the day on Monday. Tech stocks,

Nasdaq, NYSE, and the Dow Jones ended the day in green and

cryptocurrency markets saw a similar pattern. On Tuesday morning, the

crypto economy has gained 8.5% to $1.7 trillion in the last 24 hours

with leading crypto assets like bitcoin (BTC) and ethereum (ETH) jumping 7-10% in value over the last day.

source link : https://news.bitcoin.com/fearing-a-hawkish-fed-economists-focus-on-upcoming-fomc-meeting-as-global-market-rout-slows/