While the crypto economy shed billions in value this week, 18

different digital assets have accrued double-digit gains during the

last week. At the same time, the top two leading crypto assets by market

capitalization, bitcoin and ethereum, have lost between 2.8% to 6.2% in

value in seven days.

18 Crypto Assets See Values Increase by Double-Digits

Bitcoin and ethereum have lost a bit of value according to weekly

statistics and a number of alternative digital assets have done a whole

lot better. Today, the crypto economy is worth $2.36 trillion and it is

down 2.9% during the last day. BTC has shed 2.8% in value during the last seven days and ETH

has lost 6.2% since last week. However, 18 crypto tokens have accrued

double-digit gains against the U.S. dollar this past week.

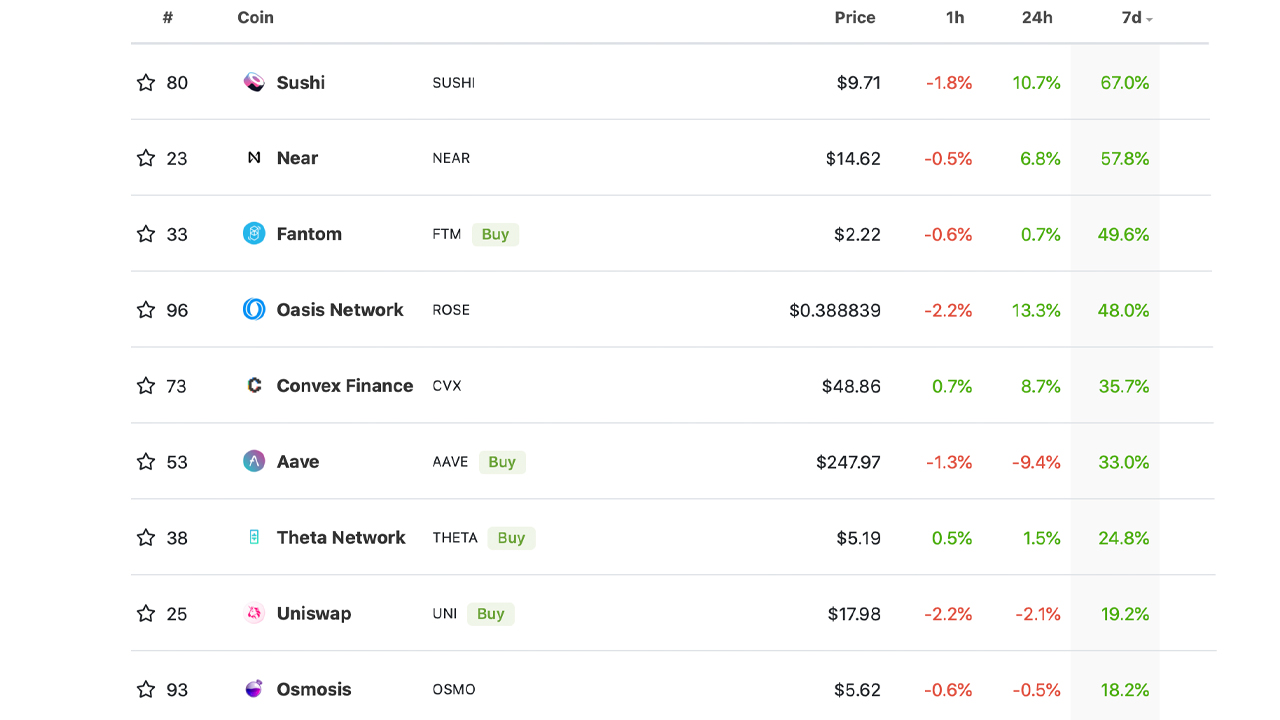

For instance, Sushiswap’s decentralized exchange (dex) token sushi

(SUSHI) has gained 67% during the last seven days. Near (NEAR) jumped

57.8%, fantom (FTM) climbed 49.6%, and oasis network (ROSE) spiked 48%

during the course of the week. Other top weekly gainers included convex

finance (+35.7%), aave (+33%), theta network (+24.8%), uniswap (+19.2%),

osmosis (+18.2%), kadena (+16.8%), iota (+15.8%), and the sandbox

(+15%).

Bitcoin and Ethereum See Sharp Drops, Huobi Global Analyst Says ‘Pay Attention to the Changes in Price Direction’

Cosmos, polkadot, enjin, monero, celo and curve token also saw double

digit gains this week as well. Out of the $2.36 trillion in value

across more than 12,000 crypto assets, BTC’s dominance is 38.3% while ethereum’s dominance is 19.1%. Discussing bitcoin (BTC)

prices with Bitcoin.com News, the co-founder of Huobi Group, Du Jun,

said that the price of bitcoin tends to stabilize and traders should

“pay attention to the changes in price direction.”

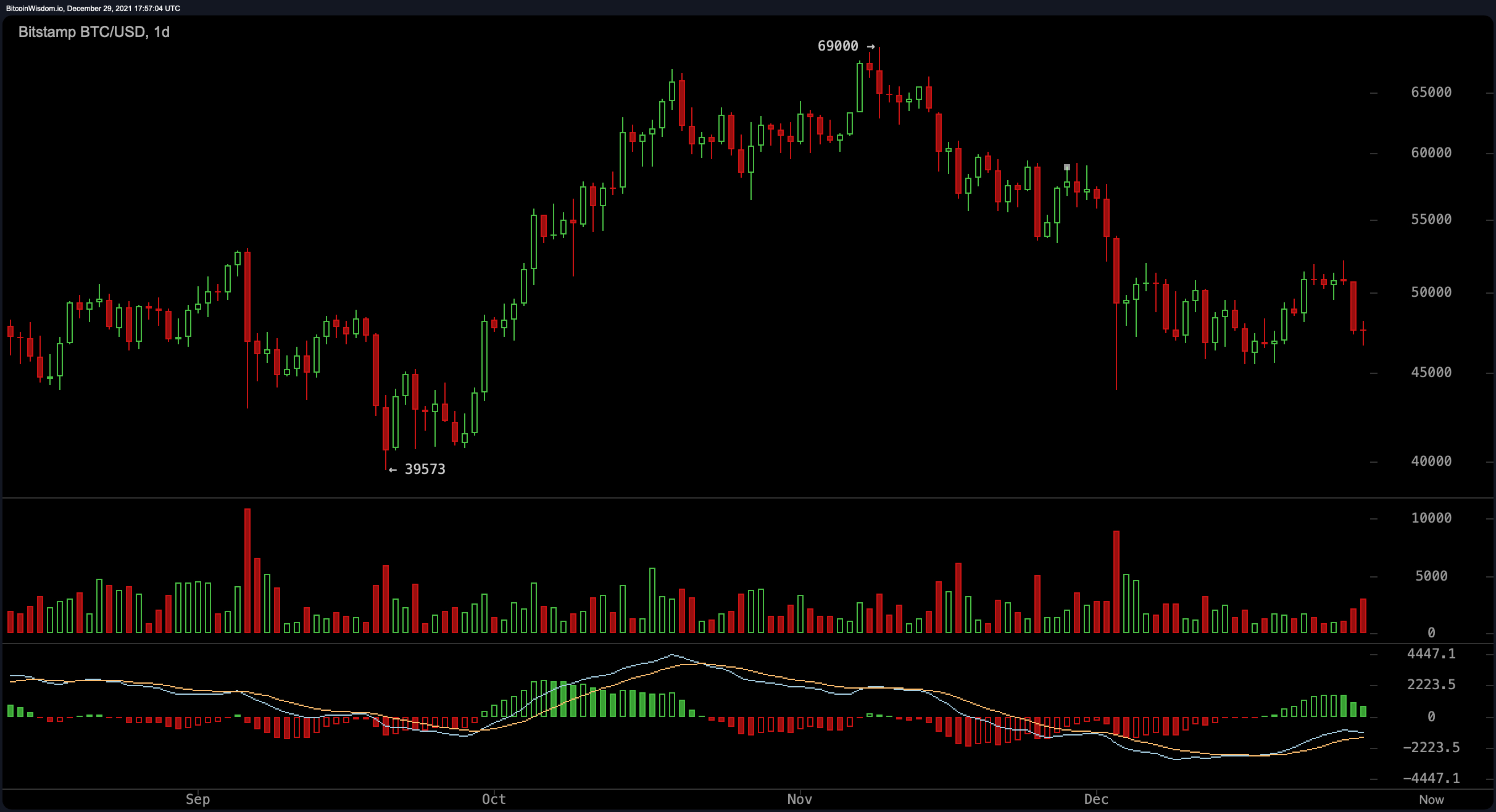

“According to data from Huobi Global, BTC’s

price stabilized during [the] daytime, after a sharp drop at night,

fluctuating back and forth from $47,500, changing directions several

times,” Huobi’s co-founder explained to our newsdesk. “From the 4h

k-line, three EMA lines descended steeply, k-line was located near the

lower rail of the Bollinger Bands, and the opening of the Bollinger

Bands expanded significantly,” Jun added. The analyst further added:

Although the decline has been blocked, the short side is still

relatively strong, especially seen from the daily line. This decline has

caused the BTC

price to fall again at a similar rate after a one-week price increase,

and there is a trend of forming a downward channel again. Short-term

upside is less likely. In short term, pay attention to the changes in

the price direction and the support of the $45,500 position below.

While the values of bitcoin (BTC) and ethereum (ETH) have both seen declines, numerous alternative crypto assets are gaining on the dominant crypto markets. A recently published study indicates that altcoins have surged threefold since 2014, and 2021’s top ten performing crypto assets outshined BTC and ETH by a longshot in terms of gains. Despite the losses bitcoin (BTC) is still up 76.1% year-to-date (YTD) and ethereum’s YTD metrics indicate ether has gained 416%.

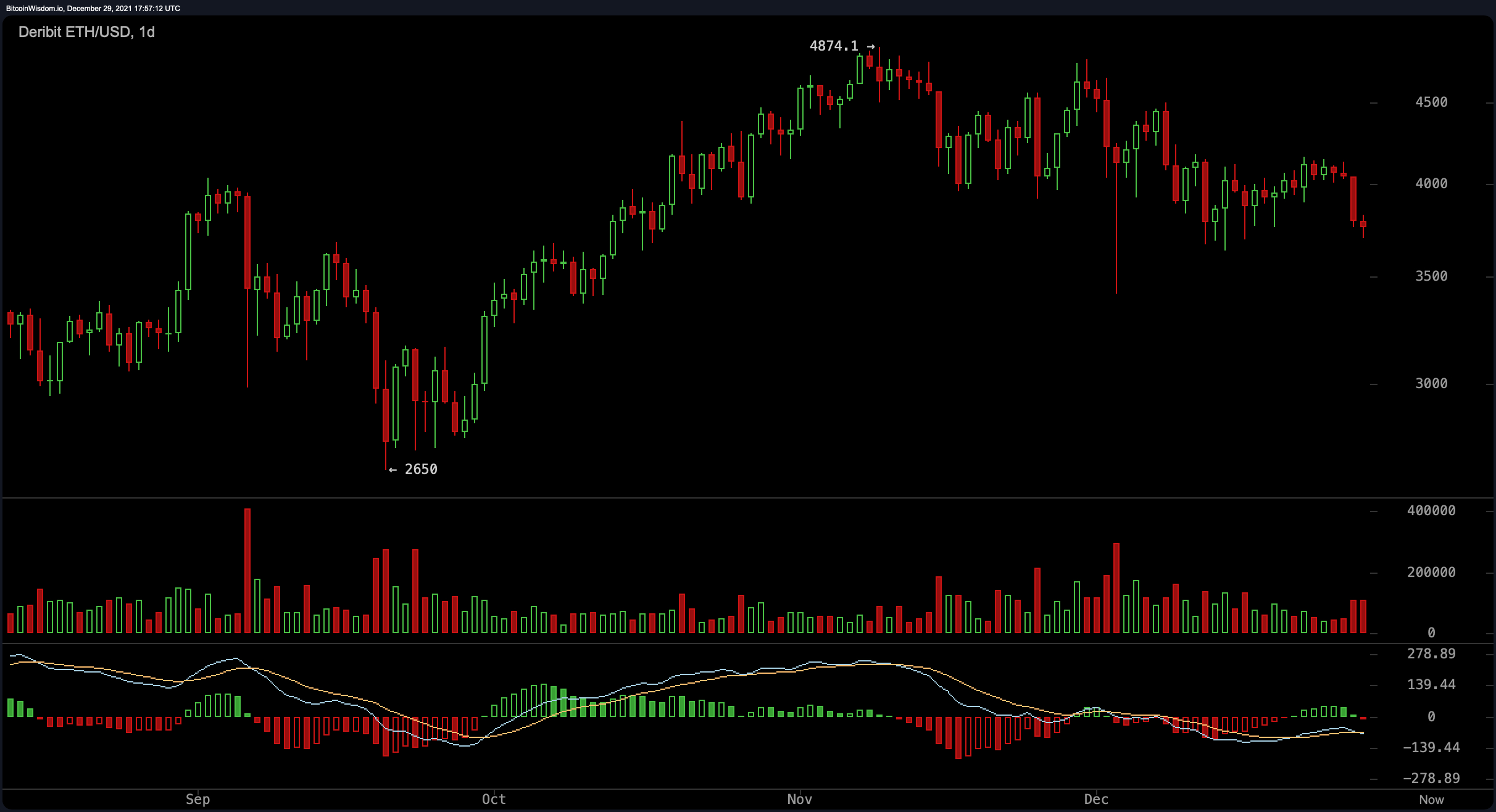

As far as ethereum (ETH) markets are concerned, Huobi Global’s Du Jun said that ethereum markets were very similar to BTC’s market patterns. “[The] price of ETH

stabilized during daytime after a sharp drop at night, oscillating

slightly back and forth, changing directions several times, echoing the BTC price trend, and it is now near $3,800,” Jun added on Wednesday. Jun’s ethereum (ETH) market outlook continued:

From the 4h k-line, the downward adjustment is strong and the

momentum is relatively large. Each moving average descended steeply, and

the trading volume increased. From [the] daily level, the downside

trend is less obvious. In the short term, pay attention to the support

of the 4680 position below. Once it breaks through, the price downward

trend will be formed.

source link : https://news.bitcoin.com/as-bitcoin-and-ethereum-see-sharp-drops-18-crypto-assets-captured-double-digit-gains-last-week/