Ethereum Transaction Fees Skyrocket

Ethereum is the second-largest crypto asset in terms of crypto market

capitalization with a $375 billion market cap or 17.4% of the crypto

economy’s $2.16 trillion. ETH is up 34.3% during the last month, but has lost 2.1% during the last two weeks. On August 27, Bitcoin.com News reported

on Ethereum having issues upgrading and the problems led to a chain

split. As that news has settled, discussion of rising Ethereum gas fees

have replaced the conversation.

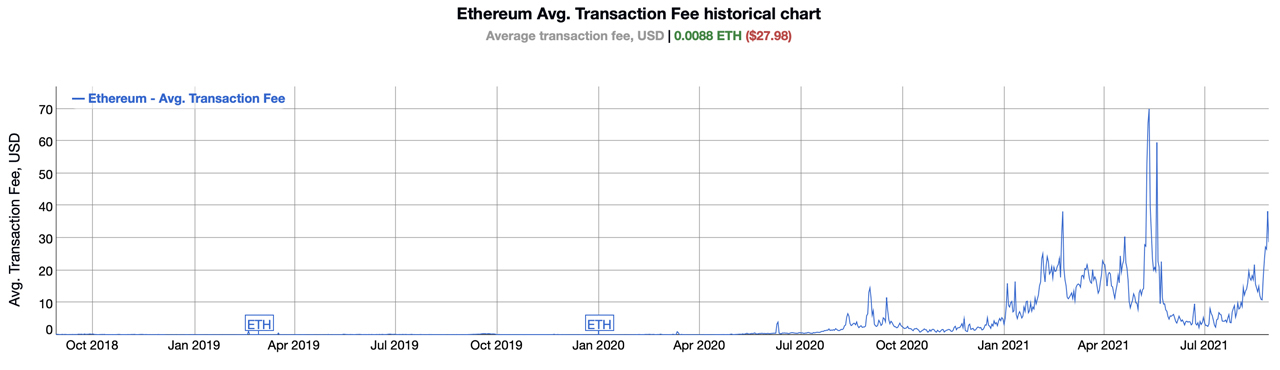

Ether fees have jumped dramatically since August 21, spiking 154.36% to today’s average transaction cost of $27.98 per transaction.

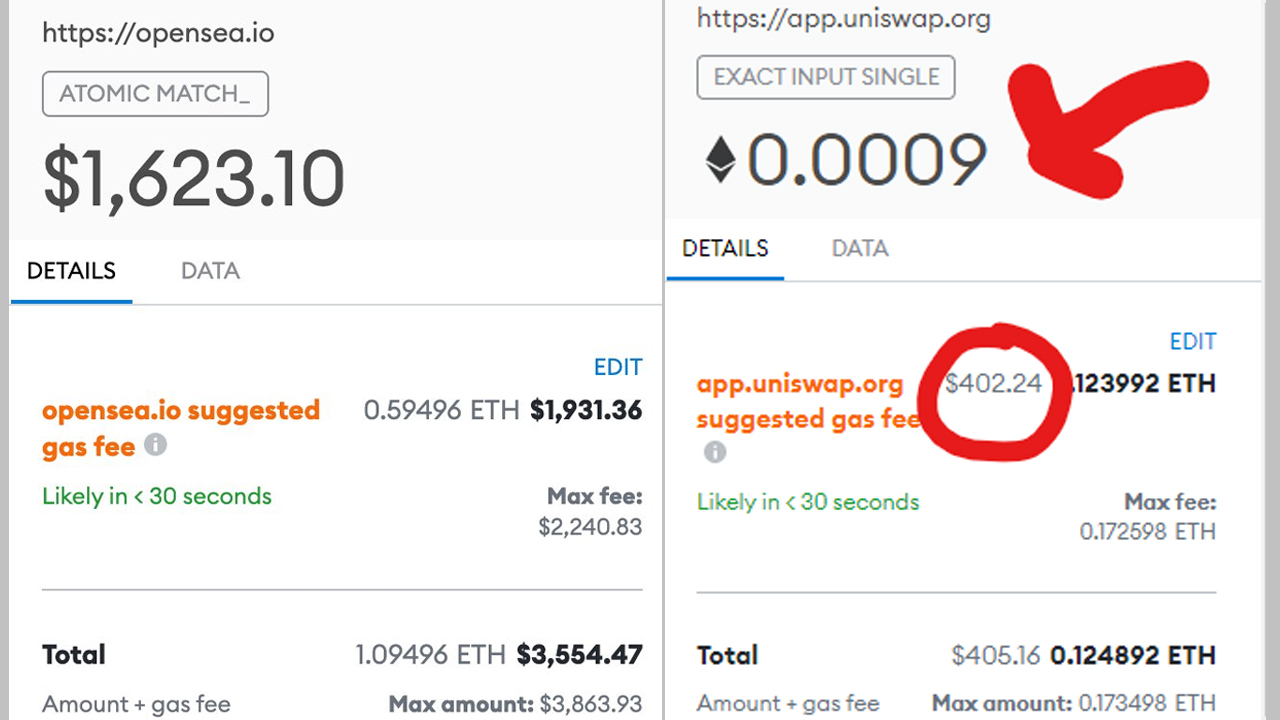

The cost to interact with smart contracts and Web3 platforms is even

worse, as people have reported on Uniswap or decentralized exchange

(dex) fees being upwards of $300 to even over $1K per interaction.

Non-fungible token (NFT) marketplace fees for places like Opensea have

significantly higher ether gas fees than usual as well.

Ethereum 2.0 Hopes, ‘Ethereum Killers,’ Gas Reducers, and Compatible Chains

The hope is that Ethereum 2.0 will fix the issues with transaction

fees and stabilize the fees to be more uniform. However, while Ethereum

developers prepare for the switch, Ethereum competitors otherwise known

as ‘ETH-Killers’ are steadily catching up to the second-largest crypto

asset.

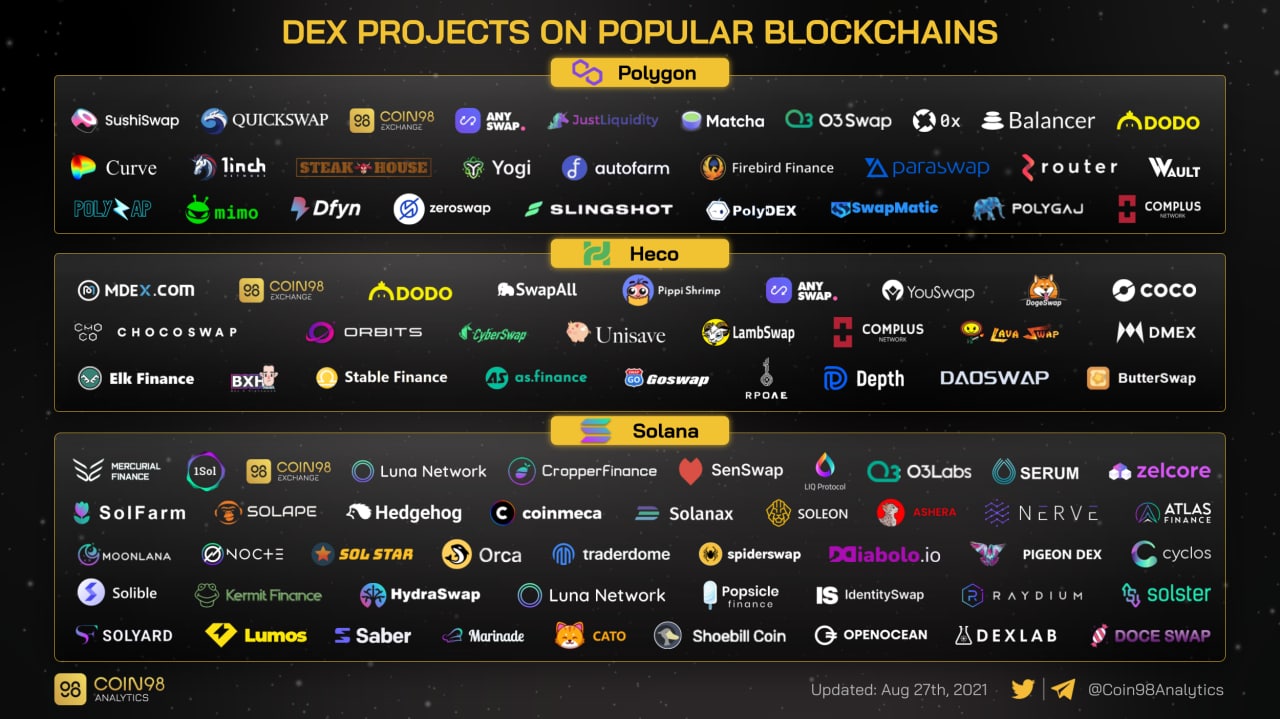

Ethereum is facing rising competition from blockchains like Binance

Smart Chain, Cardano, Solana, Polkadot, Terra, Avalanche, Tron, Cosmos,

and EOS.

All of which aim and promise to provide much lower transaction fees in

order to send funds or interact with decentralized finance (defi)

applications.

Although the Ethereum 2.0 upgrade is something these networks may

want to fear as many Ethereum proponents believe it will solve the fee

issues. Two specific projects that aim to squash ether gas fees include Optimism and Arbitrum. These two projects leverage what’s called “optimistic rollups”

and the Ethereum community is hopeful they will make progress toward

relieving ether gas costs. Additionally, there are other projects that

aim to crush ether gas costs with projects like fuel.sh, the aztec.network, starkware.co, loopring.org, zksync.io, and hermez.io.

Furthermore, already people are using projects like Polygon (MATIC)

and Hecofi to utilize Ethereum in a cheaper fashion as well. The

Ethereum community understands that the full ETH 2.0 release will not be 100% until at least some point in 2022. Until then so-called ‘ETH

Killers’ and alternative gas solutions will likely continue to increase

in demand. $27.98 or 0.0088 ether per transaction is not very enticing

to people who want to transact with ether, buy and sell NFTs, and

interact with Web3 and defi platforms.

source link : https://news.bitcoin.com/ethereum-fees-jumped-154-since-last-week-400-uniswap-fees-1k-to-interact-with-opensea/

Following the bug and the split that occurred after a great

number of Geth nodes did not upgrade, Ethereum fees have risen

dramatically since August 21, jumping from $11 per transaction to

today’s 0.0088 ether per transaction ($27.98).