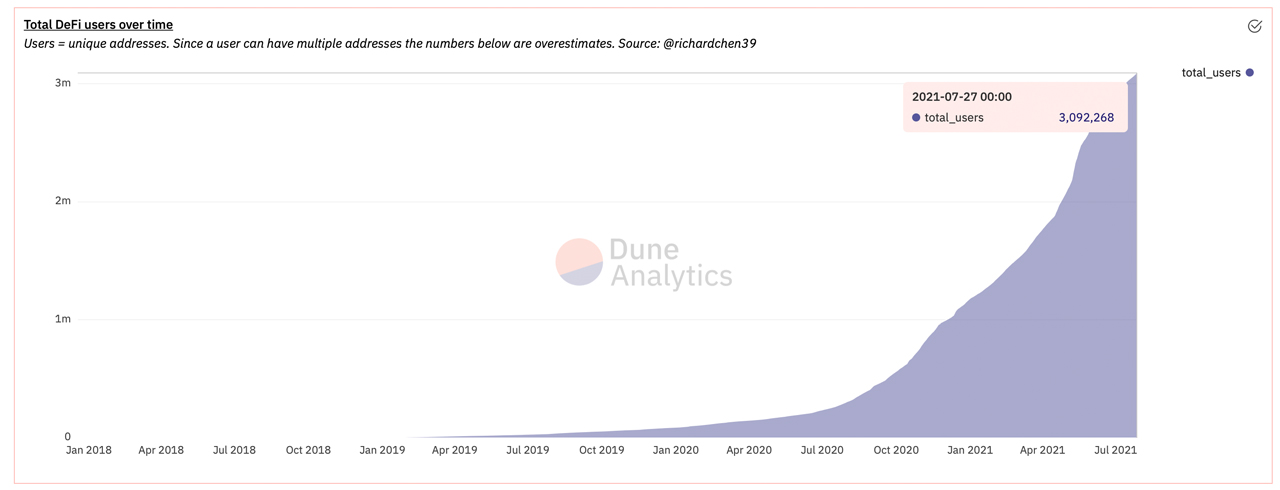

The number of users or unique addresses leveraging decentralized

finance (defi) protocols via Ethereum has risen past 3 million

according to recent statistics. A vast majority of these unique

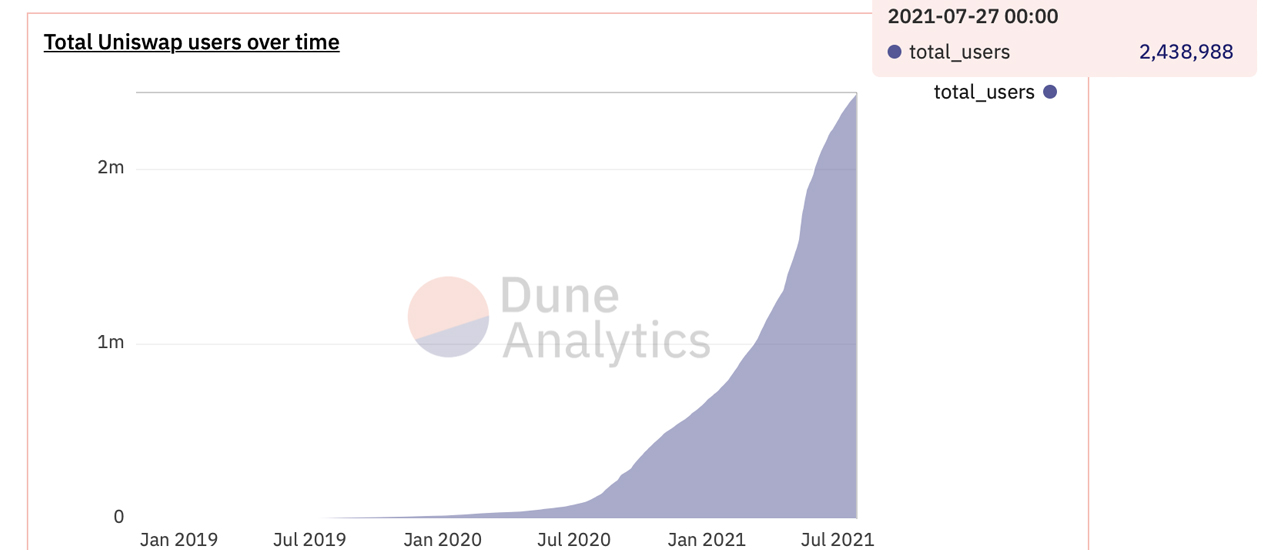

addresses use the defi protocol Uniswap, as 2.4 million users have been

recorded since December 2018.

Ethereum Defi Applications See Unique Addresses Surpass 3 Million

According to statistics from Dune Analytics,

the number of users or unique ethereum addresses utilizing defi has

jumped past the 3 million threshold this week. At the time of writing,

data shows there are 3,092,000 unique addresses recorded on July 27. The

lion’s share of these addresses stems from the decentralized exchange

(dex) platform Uniswap.

Uniswap’s dex currently has approximately 2,438,374 unique addresses

that leverage the Uniswap trading protocol. It’s worth noting, however,

that since a user can have more than one unique address, records could

be considered overestimates. Further, the data from Dune Analytics’

“Defi Users Over Time” chart only captures a snapshot of Ethereum-based

defi apps.

The defi lending application Compound holds around 326,723 addresses

on Tuesday and the liquidity protocol 1inch has around 276,924 unique

addresses. Behind Uniswap, Compound, and 1inch, are defi apps like

Sushiswap, Balancer, and Kyber, respectively.

Total Value Locked Jumps $10B, Dex Volume Grows, Defi Tokens Gather Double-Digit Gains

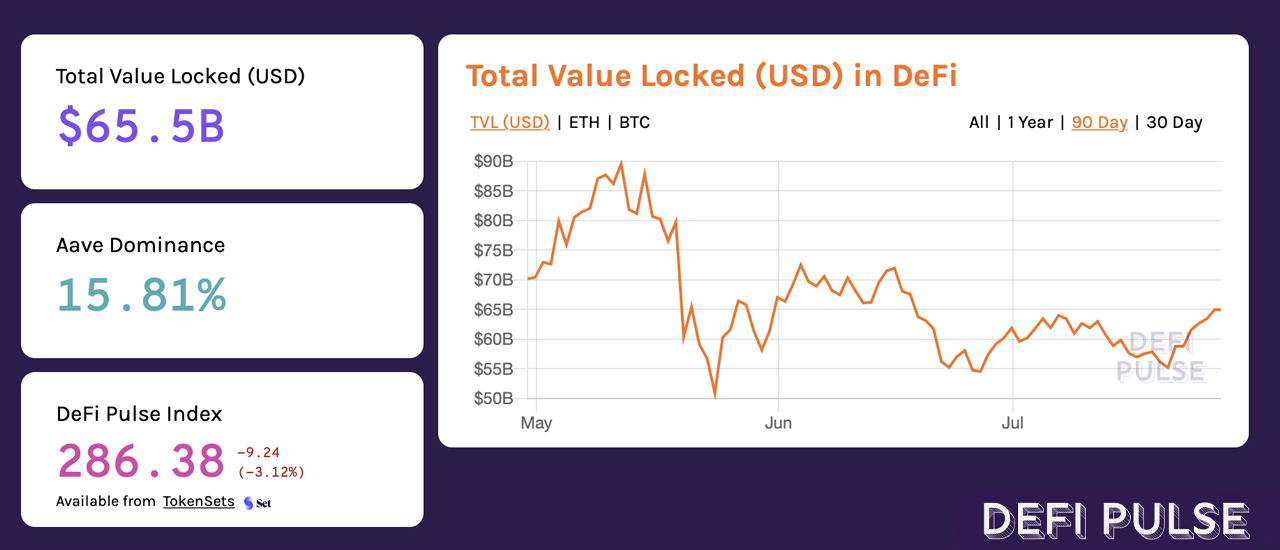

While cryptocurrency markets saw some price recovery this week, defi

crypto assets saw significant increases. Seven days ago, the total value

locked (TVL) across a myriad of defi applications recorded by defipulse.com shows the TVL was around $55 billion. The TVL metric has since increased to the current $65 billion recorded on July 27.

Decentralized exchange (dex) statistics show that there was $2.33

billion in trade volume recorded on popular dex platforms over the last

24 hours. Seven-day data indicates $15 billion in global swaps were

recorded, and Uniswap captured 64% of that volume.

These stats represent ETH-based dex platforms only. Uniswap’s volume

trade volume is followed by Sushiswap (9.6%), Curve (7.8%), and 0x

Native (5.5%). Defi tokens stemming from applications like Uniswap,

Sushiswap, and Aave saw double-digit gains after BTC’s short squeeze on Sunday evening.

source link : https://news.bitcoin.com/unique-addresses-tethered-to-ethereum-defi-apps-climb-past-3-million/